Types of Health Insurance Explained: Your Guide to Making an Informed Choice

Have you ever visited a doctor only to receive a large bill that you can’t afford to pay?

Healthcare costs are rising in the United States, and many people can’t afford to pay out-of-pocket for medical care.

Having health insurance means you get help paying for medical bills, so you won’t have to try to pay for all of them yourself.

There are many types of health insurance to choose from — some plans are more expensive than others and have different benefits.

In this article, we’ll look at six different types of health insurance plans and discuss how to choose the right one to suit your healthcare needs.

What is Health Insurance and When Would I Need it?

Health insurance helps you pay for medical care. It’s like a safety net that helps cover the expenses of seeing a doctor, visiting a hospital, or buying medication.

Over 304 million Americans have health insurance — and for good reason. Doctor visits, hospital stays, surgeries, and medications can cost thousands of dollars.

Health insurance prevents you from having to pay for all of this yourself, which is why it’s a good idea to have it.

Important Terms to Understand

Before we tell you more about the different types of health insurance, there are some important terms you need to understand first:

Premiums: This is the amount of money you pay to an insurance company each month for your plan.

Out-of-pocket costs: Even with insurance, there are some expenses you’ll have to cover with your own money, called out-of-pocket costs.

Deductibles: This is an out-of-pocket cost you’ll need to pay. It’s how much you must pay for a medical service before your health insurance starts to pay some of the cost.

Copayments (or copays): This out-of-pocket expense is a percentage of the cost of a medical service that you will need to pay – such as paying 20% of a bill. The copayment you make will depend on the plan you’re on.

Coinsurance: This is another out-of-pocket cost that you will need to pay. Once you pay your deductible, you’ll split the remaining costs with your health insurance company. Your share is known as coinsurance.

In-network providers: Your health insurance company contracts a group of healthcare providers to care for their members, known as a network. Your health plan will pay for your visits to these providers.

Out-of-network providers: These are doctors, specialists, and hospitals that aren’t covered by your health insurance and that you’ll have to pay for. Some health insurance plans might pay an amount toward the service if you visit an out-of-network provider.

Preapproval: Some health insurance companies want you to apply to them for certain medical treatments that they may not usually cover or that are very expensive. They won’t pay for these services until you have preapproval from them.

A Closer Look at the Different Types of Health Insurance Plans

Now that you know more about health insurance, let’s unpack the types of plans available for you to choose from.

Health Maintenance Organization (HMO)

This is a health plan that gives you medical care through a network of doctors and hospitals in your specific location. Your HMO is based on where you live or work.

In some cases, you can get medical treatment in other areas if your HMO is connected with other health insurance companies in different locations. This is useful if you travel away from home for long periods.

Most HMOs will ask you to choose a doctor or medical group to be your primary care physician (PCP) – the person or group who will give you general medical care. Your PCP is the doctor or medical group you’ll see for regular checkups, for example.

Advantages

HMO plans give you a wide range of medical services if you visit doctors and hospitals approved by the health insurance company.

There is generally no deductible or coinsurance for in-hospital care.

You won’t need much paperwork to be on this plan compared to the others in this article. There are no claims forms that you will need to fill out.

Premiums are usually lower because using the doctors in the plan’s network can help your health insurance company control costs.

Many of these plans offer low or no-deductible options.

Disadvantages

In many HMOs, you must get prior authorization or a referral from your PCP to see other doctors or specialists.

If you receive medical care from a healthcare provider that is not in the plan’s network of doctors, it will not be covered by your insurance unless it’s for emergency treatment. You will have to cover the cost yourself.

You’ll need prior authorization from your health insurance company before receiving certain medical services.

Preferred Provider Organization (PPO)

This health plan offers you the most freedom compared to the others listed in this article. This is because the plan allows you to see doctors and specialists without a referral from your PCP.

Advantages

Copayments and coinsurance for in-network doctors are low.

This type of health plan gives you a large network of healthcare providers and hospitals to choose from.

If you choose a healthcare provider in the plan’s network, you pay lower out-of-pocket costs than if you visit doctors who are not in the network.

Disadvantages

You will have higher out-of-pocket costs when you see doctors and specialists who are out of the plan’s network.

This plan comes with a lot of paperwork. If you see out-of-network doctors, you’ll have to file these claims yourself.

If your out-of-network doctor charges more than others in your area, you may have to pay the balance after your health insurance pays its share.

Premiums for these plans are higher than others, and they come with a deductible.

Out-of-network care is a benefit of this plan. However, you may not get the same level of coverage and benefits offered by an in-network provider when you choose a doctor outside the network.

Because your PPO plans give you more freedom to choose your preferred doctor, you may need to get more pre-approvals from your health insurance company for certain medical services.

Point of Service (POS)

Many HMOs and PPOs provide a product called Point of Service (POS). This service allows you to access healthcare providers who are not part of the HMO network.

This means you get coverage to see doctors and specialists who are out-of-network on your HMO plan.

Like PPO plans, you will need to choose a primary care provider from the plan’s network of doctors and other providers. You will pay more to see providers that are outside your HMO’s network.

Advantages

This plan gives you the freedom to choose healthcare providers that you want to visit whenever it suits you. This can help you manage a health condition by seeing one or more doctors who are not in the HMO network.

The costs of seeing an in-network healthcare provider are lower than HMO plans.

If you have a PCP, they will often take care of the paperwork and pre-approvals for you.

Disadvantages

This healthcare plan has higher premiums than an HMO.

The network of healthcare providers you get to choose from is usually smaller than a PPO plan.

You will need a referral from your Primary Care Provider to see a specialist.

If the coverage is offered for out-of-network providers, it usually comes with a higher copayment.

You would be responsible for filing any claims if you see doctors outside of the plan’s network.

High Deductible Health Plan (HDHP) with a Health Savings Account (HSA)

A high deductible health plan (HDHP) allows you to pay lower premiums for your insurance, but you’ll have higher out-of-pocket costs.

This means you’ll pay less each month but more when you see a healthcare provider compared to other plans.

An HDHP often comes with a Health Savings Account (HSA) that allows you to pay for your healthcare expenses and save for future ones without being taxed.

Whatever amount you have in your savings account will grow tax-free. You can also use this money without paying taxes.

Advantages

Your Health Savings Account can help you pay for certain out-of-pocket healthcare costs and get you closer to reaching your deductible.

You get tax-free savings with your HSA.

This plan can help you avoid paying large amounts of money for medical services, especially unplanned care like hospital stays and surgeries.

Once you reach your network deductible, your health insurance plan will pay for any medical care.

Disadvantages

Your deductible will be higher.

Until you reach your deductible, you’ll split the cost of medical care with your health plan through copayments or coinsurance.

Your out-of-pocket costs can be high if you get more medical care than you had planned.

Exclusive Provider Organization (EPO)

An Exclusive Provider Organization (EPO) is a less popular health plan, but one that has many benefits. Like HMOs, this plan only covers doctors and specialists that are in their network.

Depending on the plan you choose, you may not have to choose a primary care provider. You also don’t have to get referrals from a PCP to see a specialist.

Advantages

You have a wider selection of in-network doctors and specialists to choose from than you would with an HMO plan.

The premiums for EPO plans are lower than PPOs.

You don’t need a referral from a primary care doctor to see a specialist.

Disadvantages

The premiums for this type of plan are higher than HMOs.

These plans don’t offer out-of-network benefits. If you see a doctor who is outside of the plan’s network, your health insurance won’t cover the cost of the visit.

You’ll need more preapprovals before receiving certain healthcare services because you don’t have a primary care physician overseeing your care.

Medicare and Medicaid

Medicare is a health insurance program funded by the federal government to cover the healthcare costs of people who are 65 and older.

It also covers disabled people or those with certain chronic conditions under the age of 65. The plan offers the same coverage nationwide.

Medicaid is another federal program for low-income families, seniors, and people with mental or physical disabilities.

Advantages of Medicare

You can see any doctor or visit any hospital that accepts Medicare.

You don’t need a referral to see a specialist.

You get cover no matter where you live in the United States.

Disadvantages of Medicare

The plan doesn’t cover dental, vision, or hearing care.

You aren’t covered if you travel overseas.

You would need to buy added plans to pay premiums for prescription drugs.

Advantages of Medicaid

You will be accepted for the plan even if you have preexisting health conditions.

You don’t have to submit claims for medical services.

Disadvantages of Medicaid

You may not be covered in some states for certain medical services like dental and vision care.

You will need a referral to see a specialist.

You’re limited to only seeing doctors and visiting hospitals that accept Medicaid.

The Differences Between These Types of Health Insurance

In the table below, you can see some of the differences between each of the health insurance plans we’ve outlined above:

Type of Health Insurance | Premiums | Referrals Required? | Coverage for Out-of-Network Care? |

|---|---|---|---|

Health Maintenance Organization (HMO) | Lower | Yes | No |

Preferred Provider Organization (PPO) | Higher | No | Some |

Point of Service (POS) | Higher | Yes | Yes |

High Deductible Health Plan (HDHP) with a Health Savings Account (HSA) | Lower | No | Yes |

Exclusive Provider Organization (EPO) | Higher | Yes | No |

Medicare and Medicaid | None | No | No |

Which Health Insurance Plan is Best for Me?

Before you can choose the right health insurance plan, you should first understand your needs.

For example, if you’re in good health and you don’t have any medical conditions, you may want to choose a health insurance plan with a higher deductible.

This means you’ll have lower premiums that could save you money in the long run– which is helpful if you don’t visit the doctor often.

If you need medical care often, you’ll want to consider health insurance plans with lower deductibles and coinsurance. This means your medical costs will be more predictable if you need to see a doctor or specialist regularly.

Where Can I Get the Best Medical Advice and Treatment?

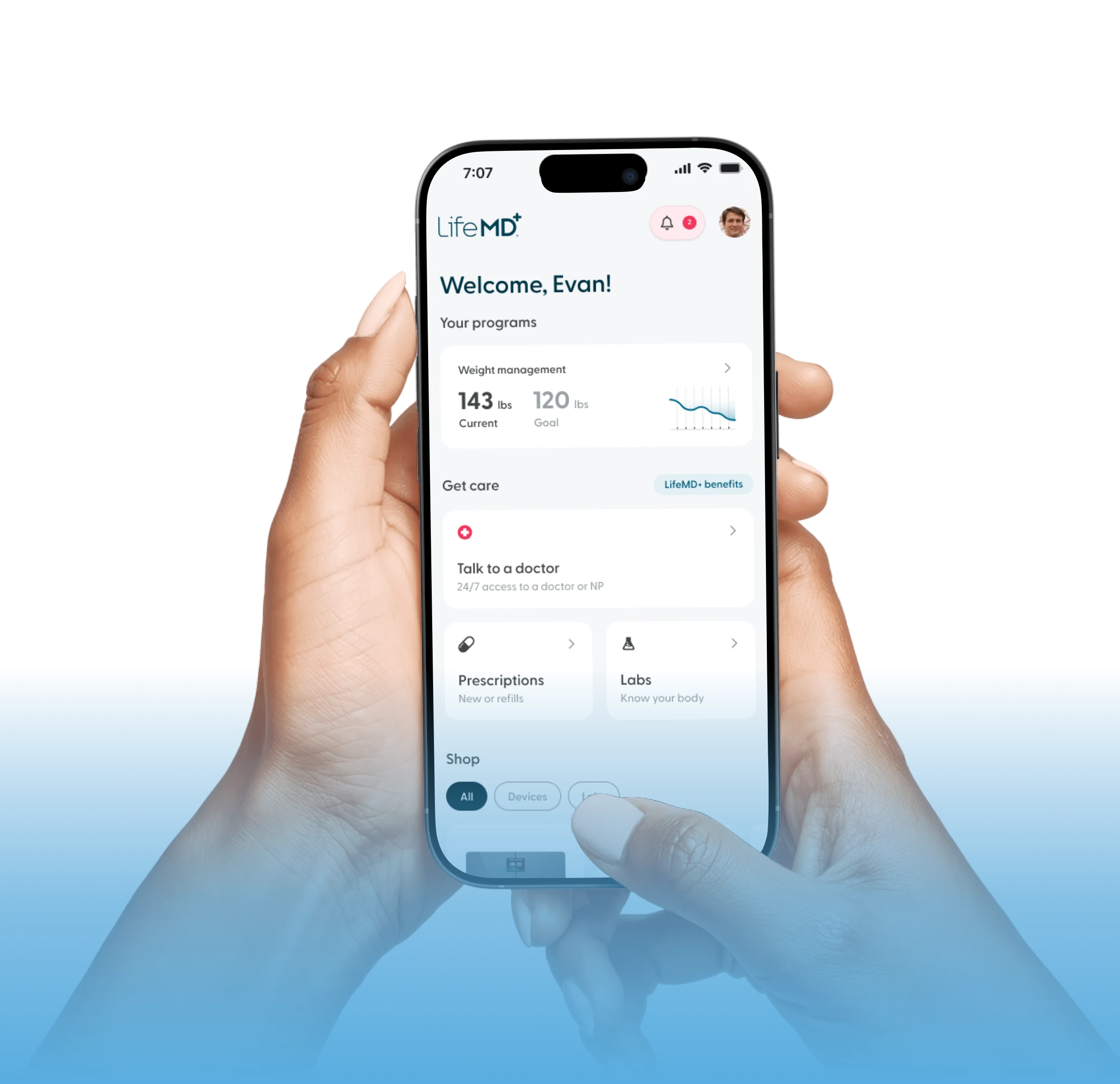

Through LifeMD, you can consult with a healthcare provider via telehealth from the comfort of your own home.

Board-certified physicians and nurse practitioners can treat a range of medical conditions and prescribe medication to help you feel better.

Make an online appointment to get started.