What is Prior Authorization?

Imagine you visit your doctor because you aren't feeling well, and they prescribe medication to alleviate your symptoms.

Then you go to the pharmacy to collect your medication, and you’re told that it requires prior authorization. This can be a frustrating delay, especially when you’re feeling ill.

But there’s a reason your health insurance company needs prior authorization — it’s how they ensure your healthcare is affordable and safe.

They do this by deciding if you really need a drug or medical service.

In this article, we’ll walk you through the prior authorization process and share some tips on how to get this approval when you need it.

What is Prior Authorization?

Prior authorization is something you need from your health insurance company if you want them to pay for certain medical treatments and medications.

Your healthcare provider needs to get approval from your health insurance when they prescribe certain medications or procedures.

If you don’t get prior authorization, your insurance won’t pay for your treatment, even if it’s covered by your health plan. This means you will have to pay for it yourself.

The reason why your health insurance company wants you to go through the prior authorization process is to make sure you really need them to pay for your treatment.

They do this to make sure only people who truly need expensive medication and treatments get them, which keeps the cost of your health insurance low.

Remember, you don’t need prior authorization if you are paying cash for your drugs or treatment. You only need approval from your health insurance company if you want them to pay for what you need.

When Do I Need Prior Authorizations?

You will need prior authorization from your insurance company for these drugs:

Brand-name medications that have generic options. Usually, your health insurance will only want to pay for generic medications because these are cheaper.

Drugs that are only meant to be taken for certain types of health conditions.

Drugs used for cosmetic treatments like plastic surgery.

Drugs that could have bad effects on your health (known as adverse effects) or that may be dangerous to take with other medications or substances (referred to as interactions).

Drugs that are usually not covered by your health insurance, but your doctor says you must take them. This is called medical necessity.

Drugs that could easily be misused or that you could become addicted to.

You will also need prior authorization for these medical services:

Scans that help doctors diagnose a health problem. These scans include MRIs, CT, and PET scans.

Medical equipment like wheelchairs or crutches.

Rehabilitation treatments like occupational or physical therapy.

Home health services like nurses or carers.

Surgery that isn’t a medical emergency — known as elective surgery.

How do I know if I need prior authorization for drugs or medical services?

If you’re not sure if you need prior authorization for a drug or medical service, contact your health insurance company.

They will let you know if your healthcare provider needs to contact them to give them all the information they need to make a decision.

You can check your health insurance plan documents or your ID card for more information about treatments, services, and medications that need prior authorization on your plan.

How Does the Prior Authorization Process Work?

Now that you know what prior authorization is, let’s unpack what the process looks like:

Getting started

If your healthcare provider prescribes a medication, you will need to visit a pharmacy.

The pharmacist will let you know if you need prior authorization. This will happen if your health insurance usually doesn’t cover the prescribed drug.

If the cost of the drug isn’t covered by your insurance, the pharmacist will let your doctor and they’ll start the prior authorization process.

Your doctor’s office will collect all the information needed to start the process, including any forms that need to be filled out about you and your condition, and these will then be sent to your insurance company.

Doctors can start the prior authorization process through automated messages, email, or phone.

Your healthcare provider can only apply for prior authorization if they’re an in-network healthcare provider.

An in-network provider means they’re covered by your health insurance. If the doctor you see isn’t an in-network provider, you’ll need to apply for prior authorization yourself.

You may need to fill out some paperwork depending on how much information your healthcare provider needs to apply for prior authorization.

These forms should be filled out carefully. If any information is missing or wrong, your insurance company could deny your prior authorization. If your prior authorization is denied, you won’t get the medication or treatment that you need.

Steps in the process

Your health insurance company will review your healthcare provider’s request for prior authorization. Usually, your request will be reviewed by pharmacists, physicians, or nurses at your insurance company.

They will check for three things — known as criteria — when they review your prior authorization request:

Medical necessity: This is when your insurer makes sure you really need the drugs or medical treatment. They’ll check if the treatment is recommended for your needs based on medical research.

Cost: Your insurer will check that the medication or treatment is the most viable option for your medical problem.

Benefits: Your insurer will check that the medical service you need is right for you and if it will continue to help you over a longer period of time.

Once your insurer reviews your request for prior authorization, they will either approve it or deny it. They may also ask for more information before they approve your request.

Your health insurance could also recommend a different treatment that is less expensive but will still work effectively.

They may want you to try this treatment to see if it works before they approve your original prior authorization request.

For example, if your doctor wants you to take a brand-name medication, your insurance company can ask you to take a generic first to see if it works. If it doesn’t work, there’s a higher chance they will approve the original medication your doctor prescribed.

Timeframes

The prior authorization process should take around two days, and you’ll hear from your pharmacist if your prior authorization has been approved or denied once your insurance company has contacted them.

But how long this process takes depends on how urgently you need your medication or treatment. It will also depend on where you live and the type of health coverage you have.

What Should I Do If My Prior Authorization Request is Denied?

If your insurance company denies your request for prior authorization, speak to your healthcare provider.

They can appeal your insurance’s decision if they think they have a good reason to do so.

There might be a simple error that was made in the application for your prior authorization. In this case, you can apply for prior authorization again, making sure the information you give to your insurance company is correct.

If you’ve checked all the paperwork that was sent to the insurance company and everything is correct, you can ask your doctor if there’s anything else they can send as motivation for prior authorization.

There might be a good reason why your doctor wants you to take a certain medication — or have a specific treatment — and they can use this information to help your prior authorization request.

If they have any information or medical notes that could prove that your prescription or treatment is needed, this should be given to your insurance company.

If you still don’t get prior authorization for your medication or treatment, you will have to pay for it yourself. But there are some things that can make this more affordable:

A higher dose: Get a prescription from your doctor for a higher-dose pill, as this is usually cheaper.

A larger supply: A 90-day supply of medication can cost less than a 30-day supply. Ask your doctor to prescribe a larger supply so you can buy it all at once.

Free samples: You could ask your doctor to give you free samples of your medication.

Patient assistance programs: If you need expensive or brand-name medications, look for discount cards or patient assistance programs that can help you save on your medication.

Shop around: Some pharmacies charge more for medications than others. Visit a few different local pharmacies to find the one that charges the least for the medication you need.

Do I Need Prior Authorization in an Emergency?

If you need emergency medical treatment, your health insurance company won’t expect you to apply for prior authorization.

But in some situations, your insurer will want to do the prior authorization process after your medical emergency before they cover your treatment costs.

Will I Need Prior Authorization for Medicare?

Medicare Part A and Part B don’t require prior authorization.

If you’re on a Medicare Advantage plan, you will need prior authorization for some medical treatments and medications.

Can You Speed Up the Prior Authorization Process?

There are some steps you can take that can help make sure your prior authorization goes smoothly:

Verify your information

If you don’t give your insurer the right information or if there are errors on the forms you fill out, the prior authorization process can take longer. If there is missing information, your insurer will first ask you for this before they give you prior authorization.

Speak to your health insurance company directly

Although your doctor’s office will apply for prior authorization, it helps to contact your health insurance company directly.

You can tell them that you need your medication or treatment urgently and find out if there’s any information they need to make the process faster.

Some health insurance companies will allow you to submit an urgent request for a quicker decision.

Buy your medication with cash and wait for a reimbursement

Although it is risky to do this, you can purchase your medication yourself while you wait for your insurance to approve your prior authorization.

If they approve your request, they will pay you back for your medication, which is also known as reimbursement.

Stay organized

It’s important to keep track of everything while you’re applying for prior authorization. Organize your paperwork, as you may need this later if your request is denied.

Keep a record of all your paperwork in case you need to apply for prior authorization in the future.

Keep up to date on deadlines

Your doctor’s office will be able to give you information about the due dates for all the information you need to give to your insurer.

You should know these dates and keep track of them so you don’t miss a deadline. Missing an important date could mean your prior authorization gets denied.

Where Can I Get Medical Treatment Online?

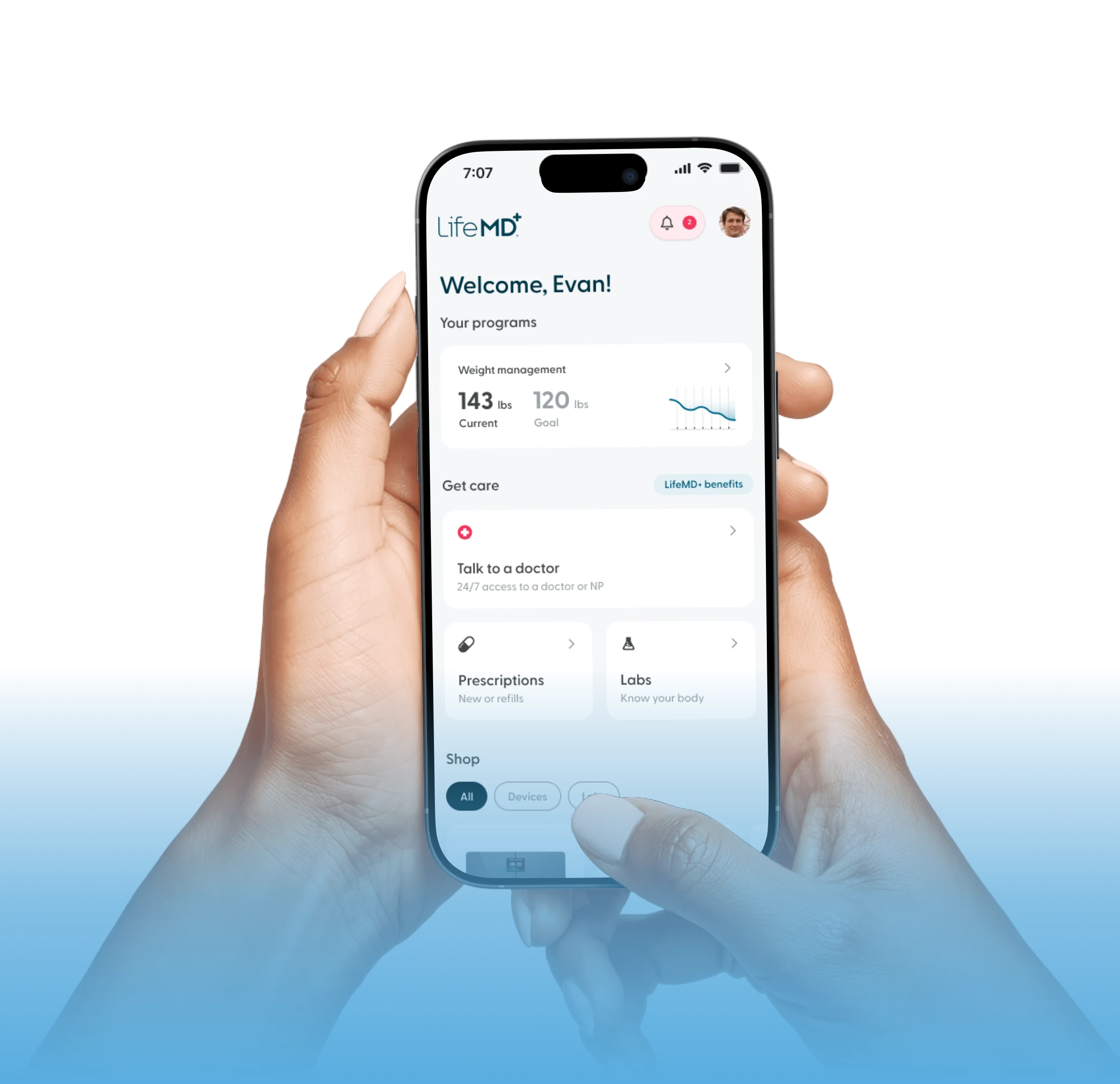

With LifeMD, you can get medical treatment and prescriptions through our advanced telehealth platform.

A team of board-certified physicians and nurse practitioners are available to provide treatment and advice for weight management, UTIs, insomnia, diabetes, asthma, and many more conditions.

You’ll also get access to 24/7 messaging with a care team who can answer any questions you have. Skip the waiting room and book your online consultation, today.