How to Choose Health Insurance: A Step-by-Step Guide

Choosing the right health insurance is a big step toward maintaining your health.

It can be a daunting decision, especially if you've never done it before and you don’t know where to start.

Whether you’re applying for health insurance for the first time or transitioning to a new phase of life, understanding the ins and outs of the process is essential.

In this article, we’ll guide you through the process of choosing health insurance to help you make the right decision for your medical needs and general lifestyle.

Understanding Health Insurance

Health insurance is a type of coverage that pays for some medical and surgical expenses.

It can protect you from high, unexpected medical costs and it provides additional benefits like dental, vision, and vaccine access to help you maintain your health.

When choosing health insurance, it’s important to understand a few key terms you may encounter.

This can help you make sense of different health insurance options and feel confident that you are making the best choice.

Key Health Insurance Terms | Definition |

|---|---|

Premium | This is the amount you pay, usually every month, to have your health insurance. Think of it as a subscription fee that keeps your coverage active. As long as you pay your premium, you will have access to your health insurance benefits. |

Deductible | This is the amount you need to pay using your own money for medical services before your insurance starts to pay its share. Being on a high-deductible health plan generally means you’ll have to pay a lower monthly premium. |

Copayment | This is a fixed amount you pay for a covered healthcare service — like a doctor's visit or medication — when you receive it. It's typically a small portion of the total cost. Your health insurance will cover the remaining portion. |

Coinsurance | This is the percentage of costs you pay after you've met your deductible. For example, if your insurance covers 70% of an expense, you would pay the remaining 30%. |

Out-of-pocket | This is the amount that you may have to pay for services that aren’t covered by your insurance at all. It typically refers to money you have to pay out of your personal account. |

Provider network | This is a group of doctors, hospitals, and other healthcare providers that your insurance company works with. They are typically contracted to provide medical care to insurance plan members. |

Types of health insurance

There are different types of health insurance designed to suit a variety of medical needs. Let’s take a look at each of these.

Private insurance

These plans are purchased by individuals in their own capacity.

Private insurance can be more expensive but usually offers greater flexibility when it comes to choosing the facilities and services you want to use.

For example, let’s say you need to be hospitalized for surgery. A private health insurance plan may allow you to use your preferred hospital, but non-private options may require you to use a network hospital.

Employer-sponsored insurance

Some employers may offer health insurance benefits to employees as part of their monthly compensation.

In these cases, your employer will cover a portion of the insurance premium, and you will pay the rest. This typically lowers your overall cost.

Government programs

Programs like Medicare and Medicaid are state and government-funded health insurance programs that cover medical expenses for certain groups of people.

You typically have to meet a set of requirements — such as having a low income, being over a certain age, or suffering from specific health conditions — to be eligible for these insurance options.

5 Key Factors to Consider When Choosing Health Insurance

Coverage needs

Before deciding on health insurance, carefully think about what exactly you need coverage for.

For example, if you are generally healthy and don’t require frequent access to medical services, you most likely won’t need a comprehensive insurance plan.

On the other hand, if you suffer from comorbidities or require ongoing treatments, insurance that offers all-inclusive coverage would be your best choice.

Do some research on plans with various coverage options and compare them to determine the best option for your health needs.

Costs

When choosing health insurance, consider what you can afford to spend each month.

Ideally, you want to choose a plan that gives you the best value for your money while also ensuring that you have access to the medical services you need.

You might want to consider:

If you would rather pay higher monthly premiums but have lower costs when you visit a healthcare provider or,

If you want a lower monthly premium but potentially have more out-of-pocket costs when visiting a healthcare provider.

Your monthly premium is what keeps your health coverage active and gives you access to medical services.

If you are unable to meet this amount every month, your insurance may be paused, and you’ll have to pay out-of-pocket for any services you need.

So it’s important to choose a plan that you can comfortably afford.

Premiums vs. out-of-pocket costs

Premiums are the regular payments made to maintain your health insurance.

While a lower monthly premium may seem like a good option, it's often paired with higher deductibles and copays. This means you'll usually pay more when accessing services.

On the other hand, higher premiums tend to result in lower out-of-pocket expenses when receiving medical care. This can be great if you frequently use medical services.

Renewal policies and rate increases

Do some research on how the insurer approaches policy renewals and rate adjustments over time.

Some insurers have steep rate increases at renewal, particularly after initial sign-up discounts expire.

Understanding these policies will help you budget for future healthcare costs and avoid unexpected increases.

Provider network preferences

Many health insurance plans require you to use predetermined lists of network providers when you need medical services.

Remember that network providers are a group of healthcare providers that your insurance company has contracted to provide medical care to members.

When choosing a health insurance plan, consider your network provider preferences. Here are some important questions to ask yourself:

Does the insurance you’re considering provide access to medical facilities you may need to visit in their network?

Do they have the option to visit providers outside of the network at no extra cost?

Will you need to switch to a new doctor or healthcare provider when you apply for this insurance plan?

What are the copayments for visiting providers outside of the network? Is this something you can afford?

It’s often better to opt for a plan with an extensive network of providers — ensuring that you don’t experience delays in medical coverage — even if it comes at a slightly higher cost.

Life events

Consider any upcoming or existing life events when choosing your health insurance to cover all your medical needs. For example:

Will you be aging out of your parents’ insurance soon?

Are you getting married soon?

Are you thinking of starting a family in the next year or so?

Do you have any children?

Are you relocating to another state?

Do you expect any changes in your employment status?

Does your income make you eligible for any discounts or subsidies?

Are you retiring soon?

Depending on these life events, you can choose a plan that potentially offers additional benefits to accommodate your changing health status.

For example, if you’re planning on falling pregnant soon, you’ll need to choose a plan that offers benefits like pre- and postnatal care, fertility care, and essential doctors’ visits.

Additional benefits

Many plans offer additional benefits beyond standard medical, surgical, and hospital coverage.

These can include mental health services, physical therapy, chiropractic care, and even health and wellness incentives.

Determine which additional benefits align with your health priorities to get the most comprehensive coverage.

Frequently Asked Questions (FAQs)

Can I get health insurance if I fall into a low-income category?

If you are in a low-income category, you may qualify for a subsidized health insurance plan through programs such as:

The Affordable Care Health Act health insurance marketplace — also known as Obamacare

These plans typically provide members with comprehensive coverage for certain medical services at no cost. In some cases, you may be charged a low monthly premium.

The program you qualify for will depend on your state’s income criteria, and you can visit their Health Department’s website for more information on this.

How long can you stay on your parents’ insurance?

Young adults can stay on their parents’ health insurance plan until they turn 26, regardless of marital status, residence, or financial independence.

If you are aging out of your parents’ insurance, you may want to look at plans you can afford as soon as possible.

If you see a certain provider or have specific medications covered under your parents’ insurance, consider plans that cover these to ensure your health needs are met.

Do you have to get new health insurance if you move?

If you move to a new state, you'll typically need to enroll in a new health insurance plan. This is because different states have different health insurance providers and plans.

Even if you relocate within the same state you may require a change if your current plan's provider network does not cover your new area.

How do I qualify for Medicare or Medicaid?

Medicare is available to individuals who are 65 years old or older, certain younger people with disabilities, or certain chronic conditions, such as end-stage renal disease (ESRD).

Medicaid eligibility is based on income and varies by state. It is designed to assist low-income individuals and families by providing affordable health insurance.

You can find out if you are eligible for these programs by visiting the website of the Social Security Administration (SSA) and signing up for Medicare.

If you are eligible, you will receive further information via email. If not, your application will be denied.

Do I need health insurance if I’m healthy?

Health insurance is an important part of taking care of your well-being, even if you don’t suffer from any illnesses.

Not only does insurance provide coverage for unexpected medical costs — like accidents or sudden illness — but it also covers preventative care.

This involves services that can help you maintain your health and prevent more serious conditions in the future.

Can I change my health insurance plan after I’ve applied?

You can change your health insurance plan during the annual open enrollment period.

It’s also possible to update your plan if you experience a qualifying life event — like marriage, childbirth, or loss of other coverage.

In these cases, you may be eligible for a special enrollment period to change your plan outside of the open enrollment.

You are also able to upgrade your coverage. The time period during which you can do this will depend on your insurance provider.

For the most up-to-date information about plan changes, visit your health insurance provider’s website.

How do I know if my health insurance is actually good?

Determining if your health insurance is good will depend on the level of coverage you need versus what your plan provides.

For example, a health insurance plan that only covers basic expenses is probably not a good option if you require extensive coverage.

A good health insurance plan provides sufficient coverage for a variety of medical needs at a reasonable cost. It should typically also include a network of reputable doctors and hospitals.

What does health insurance usually cost?

The cost of health insurance varies widely based on factors like:

The type of plan

Your age

Geographic location

Tobacco use

The level of coverage you need

On average, the monthly premiums can range from a few hundred dollars for basic individual plans to over a thousand dollars for more comprehensive family plans.

Where Can I Get Dedicated Medical Treatment and Advice?

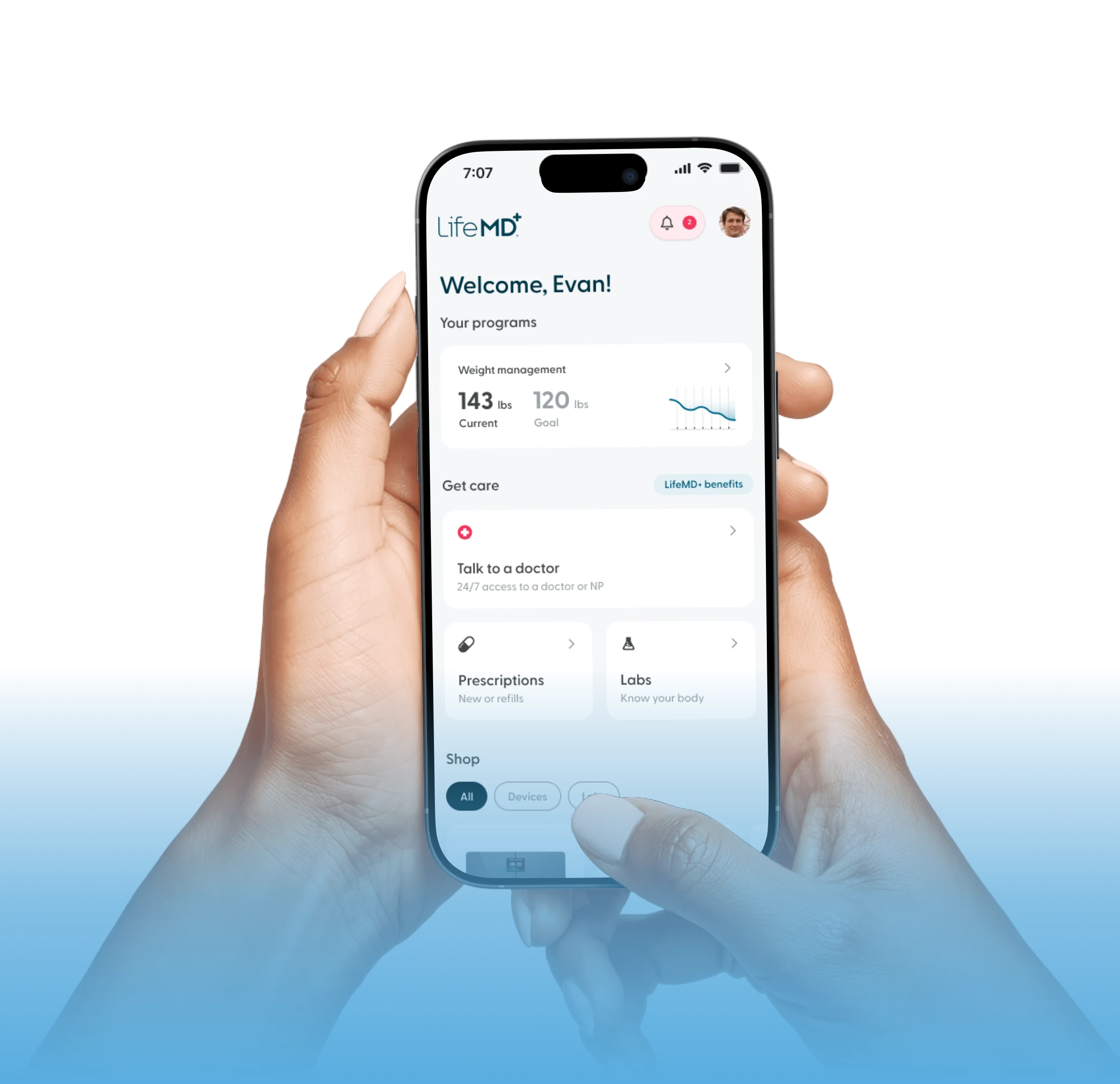

Through LifeMD, you can consult with a qualified healthcare provider from the comfort of your own home.

A team of board-certified physicians and nurse practitioners can treat a range of medical conditions, order blood work, and prescribe medication to help you take care of your well-being.

Book your online appointment today.