What Does Medicare Cover? A Detailed Look at Your Healthcare Options

Nearly 65 million Americans rely on Medicare to access healthcare and manage medical expenses, making it one of the most important insurance programs in the U.S.

But even though Medicare provides comprehensive coverage, you should know where the gaps are and how to navigate them to avoid unexpected healthcare expenses.

In this article, we’ll explore what exactly Medicare covers and how to make the most of this coverage to ensure you live a healthy life.

Term | Definition |

|---|---|

Out-of-pocket costs | These are medical services that your insurance does not cover and that you’ll have to pay for yourself. |

Copayment | A fixed amount you have to pay for certain healthcare services. This amount is predetermined by your health insurance. |

Deductibles | The amount you pay for medical services or medications before your health plan begins to share the cost. |

Coinsurance | A portion of the medical cost you pay after your deductible has been met. |

What is Medicare?

Medicare is a federal health insurance program that provides affordable healthcare services to people living in the United States.

It primarily assists senior citizens or those nearing retirement age — 65 and older — or individuals with disabilities and other chronic conditions.

This program helps to fund the costs of treatments, medicine, and medical services under certain conditions.

How do I know if I’m eligible for Medicare?

Many factors will influence whether you’ll be granted Medicare coverage. We’ve compiled them in the table below:

Category | Eligibility Criteria | Additional Requirements |

|---|---|---|

Age-Based Eligibility | U.S. citizens who are 65 years of age and older. | You must be a U.S. citizen or a permanent legal resident who has lived in the country for at least five years. |

Disability-Based Eligibility | Citizens under the age of 65 who have been receiving Social Security Disability Insurance (SSDI) for 24 months or more. If you suffer from a chronic disease — such as amyotrophic lateral sclerosis (ALS) or end-stage renal disease (ESRD). | You must be a U.S. citizen or have a permanent legal residence in the U.S. ALS patients are automatically eligible as soon as their SSDI benefits start. ESRD patients must apply through Social Security as enrollment is not automatic. |

Other Considerations | In addition to either being a U.S. citizen or having permanent legal residency, you or your spouse must have: - Been employed for at least 10 years - Paid Medicare taxes for at least 10 years Under these conditions, you can receive Medicare Part A without paying any premiums | N/A. |

If you do not fall into one or more of these categories, you are unfortunately ineligible for Medicare.

Other ways to determine your specific eligibility

If you are still unsure about your eligibility, there are other ways to check if you qualify for Medicare. Let’s take a look at what these are.

Check with Social Security

The Social Security Administration (SSA) is one of the best resources to help you determine your eligibility for Medicare.

You can visit their website, head to your local SSA office, or call the hotline to ask the staff about your Medicare eligibility.

SSA Contact Details

Hotline: 1-800-772-1213

Website: https://www.ssa.gov/

Find your closest SSA office: https://secure.ssa.gov/ICON/main.jsp

Use online tools

There are also a few online tools you can use to determine your eligibility:

Medicare eligibility calculator: The official Medicare website features a handy eligibility calculator that provides a simple way to check your eligibility. By entering basic information, such as your age and certain health conditions, you can get a quick assessment of your eligibility status.

Your Social Security account: When you set up a "my Social Security" account online, you can access personalized information about your eligibility for Medicare. This account provides detailed information about your work credits and insurance status, which are critical for determining your eligibility — especially if you are under 65 and qualify through disability.

A Closer Look at the Different Medicare Coverage Options

Part A: Hospital Insurance

Medicare Part A is a form of basic hospital insurance that covers inpatient care at relevant facilities. Let’s take a closer look at the services that are covered by Part A.

Inpatient hospital care

This includes any care received while admitted to a hospital — such as bed and board, nursing services, and medications — as part of your treatment.

It also covers other inpatient services — including physical therapy (PT) and occupational therapy (OT) — or supplies you may need to complete your treatment plan.

Skilled nursing facility care

This coverage includes services you receive in a skilled nursing facility after a hospital stay of at least three days. It covers:

A private room

Meals

A range of therapeutic and rehabilitation services — such as PT or OT — if these are needed to treat a condition you were diagnosed with during your hospital stay or that worsened while you were admitted

Hospice

Medicare Part A covers hospice care for terminally ill patients who choose palliative care — also known as comfort care — at the end of life. Coverage includes:

Drugs for symptom control and pain relief

Medical, nursing, and social services

Grief and loss counseling for the patient and their family.

Hospice care coverage is currently only available for terminally ill patients.

Home health care

Part A may cover limited home health services such as nursing care, physical therapy, speech-language pathology services, and continued occupational services. It also includes:

Medical social services, including counseling

Durable medical equipment (DME), like crutches, wheelchairs, or walkers

Medical supplies for home use, such as thermometers, first aid kits, ointments, and bandages

Part-time or intermittent health aide care

Injectable osteoporosis drugs for women

This coverage is available to individuals who:

Have trouble leaving their homes unassisted — including having to use a cane, wheelchair, walker, crutches, or special transportation — because of illness or injury

Are advised to avoid leaving their homes because of their condition

Struggle to leave their homes under normal circumstances because of the effort required

A doctor or licensed healthcare provider — like a nurse — must have a face-to-face visit with you to confirm that you qualify for this coverage.

Your coverage will also be subject to a home care plan developed by your doctor and approved by your insurance.

What is the cost of Part A?

Most people do not pay a monthly premium for Part A, provided they or their spouse paid Medicare taxes while employed. This is often referred to as “premium-free Part A”.

If you don’t qualify for premium-free Medicare but you are eligible for the insurance program, you might be able to pay a monthly fee for Part A.

This can cost either $278 or $505 per month, depending on how long you or your spouse worked and paid Medicare taxes.

Part A also has specific costs and deductibles associated with their coverage. This can be viewed on their website.

Part B: Medical Insurance

Part B covers medical insurance, including doctors’ visits and any other necessary medical services or supplies. This also includes:

Preventive services or healthcare intended to prevent illness, such as screenings and vaccinations

Ambulance services

DME

Home health care

What is the cost of Part B?

There is a standard monthly premium, which most people choose to pay. In 2024, this amount starts at $174.70 per month.

You may pay a higher premium if you are single or married, depending on your monthly adjusted income.

Key Point: What You Should Know About the Part B Penalty

Individuals who don’t have group health insurance from an employer and fail to sign up for Medicare Part B at 65 will likely pay a penalty if they decide they need it at a later stage.

The penalty usually amounts to 10% of the standard premium for each year that you delayed getting Medicare. This is a penalty that must be paid until the end of life.

Part C: Medicare Advantage Plans

Medicare Advantage — or Part C — is a type of healthcare plan offered by private insurance companies.

It’s an alternative way to receive your Medicare benefits and typically provides the same benefits as Part A, Part B, and Part D (which we will discuss next).

Part C also includes additional coverage for services, such as:

Dental

Hearing

Vision

Wellness

If you’re on this plan, you will need to use specific doctors in a provider network if you require any medical services.

This means you’ll only be able to see doctors who are approved by your health insurance, and not necessarily your regular healthcare provider.

You might also need a referral from a doctor to see a specialist.

Your medical services won’t be covered if you use a doctor outside of the provider network, and you will have to pay the full cost of this yourself.

What is the cost of Part C?

The cost of Part C will vary by plan, location, and services used or required.

In most cases, individuals will pay their part B premium, plus an additional amount determined by the insurance company.

Part D: Prescription Drug Coverage

Medicare Part D is an additional plan that adds prescription drug coverage to Part A, B, and C insurance options.

If you go to the pharmacy for your prescription drugs, recommended shots, or vaccines, Part D will cover this cost.

What is the cost of Part D?

Part D plans that are offered by private health insurance companies require a monthly premium of around $55.50.

Similar to Part B, you’ll be liable to a late penalty premium if you don’t sign up within 8 months of turning 65.

The Part D penalty is 1% of the national base beneficiary premium multiplied by the number of months you’re late when enrolling. In 2024, this amounts to $34.70 times the number of missed months.

What is Excluded from Medicare Cover?

While Medicare provides broad coverage for many health-related services and supplies, there are several areas where coverage is limited or unavailable.

If you require any of the services below, you will need to budget for out-of-pocket costs if you don’t have a medical plan to supplement them — like Part C or D.

Typical exclusions from Original Medicare (Part A and B) coverage include:

Long-term care: Medicare does not cover custodial care if that’s the only care you require. Most nursing home care — including services like bathing, dressing, and eating — is custodial and will typically not be covered.

Dental: Original Medicare doesn’t cover most dental care, including cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices.

Vision care: Routine eye exams for prescription glasses aren’t covered. Eyeglasses and contact lenses may only be covered after cataract surgery that implants an intraocular lens.

Hearing aids: Original Medicare doesn’t cover hearing aids or exams for fitting these devices.

Cosmetic surgery: Original Medicare doesn’t cover cosmetic surgery unless it’s required due to an accidental injury or to improve the function of a malformed body part.

Alternative medicine: Treatments like acupuncture, chiropractic services, or any other forms of alternative or complementary medicine usually aren't covered.

Some surgeries: Any surgery deemed not medically necessary won’t be covered by Original Medicare. This includes procedures like plastic surgery or elective cosmetic procedures unless they form part of a treatment regime for a covered diagnosis.

Non emergency transportation: Transportation to and from your healthcare provider — such as ambulance services — isn’t covered unless medically necessary.

Healthcare while traveling outside of the U.S.: Your medical costs won’t be covered outside of the U.S. and its territories. Under specific circumstances, medical costs may be covered when traveling to Canada or Mexico.

Prescription drugs: Original Medicare (Part A and B) doesn’t cover outpatient prescription drugs. However, you can purchase Part D for drug coverage.

Foot care: Routine foot care — including the cutting or removal of corns and calluses, trimming of nails, and other hygienic services — are not covered by Original Medicare.

Do I Have Any Extra Coverage Options?

Medicare may offer comprehensive health insurance, but there are still areas where it may fall short — such as copayments, coinsurance, and deductibles.

To help cover these out-of-pocket costs, beneficiaries have options for additional insurance. These are outlined below:

Medigap (Medicare Supplement Insurance)

Supplemental health insurance is like adding another layer of clothing on a chilly day.

Just as those additional layers provide warmth and protection against the cold, supplemental health insurance offers an extra level of coverage above what your primary health insurance provides.

Medigap is a supplemental insurance that you can buy from a private company to help cover some healthcare costs.

The policy is an add-on to your Original Medicare (Part A and B) benefits. For example, if Medicare covers 80% of your outpatient care, Medigap can pay the remaining 20%.

To be eligible for Medigap, you must have Medicare Part A and B.

The best time to purchase a Medigap policy is during your 6-month Open Enrollment Period, which starts in the first month you have Medicare.

During this time, you can buy any Medigap policy sold in your state for the same price as individuals in good health, even if you have extensive health issues.

Special Needs Plans (SNPs)

SNPs are a type of Medicare Advantage Plan (Part C) that provides specialized care for specific people, such as those with chronic conditions or who live in nursing homes.

You still have to be eligible for Original Medicare to access SNPs.

Employer Union Plans

If you or your spouse is still working, you might have access to health insurance through an employer or union that can work with Medicare to extend your coverage.

Where Can I Access and Learn More About Telehealth Services?

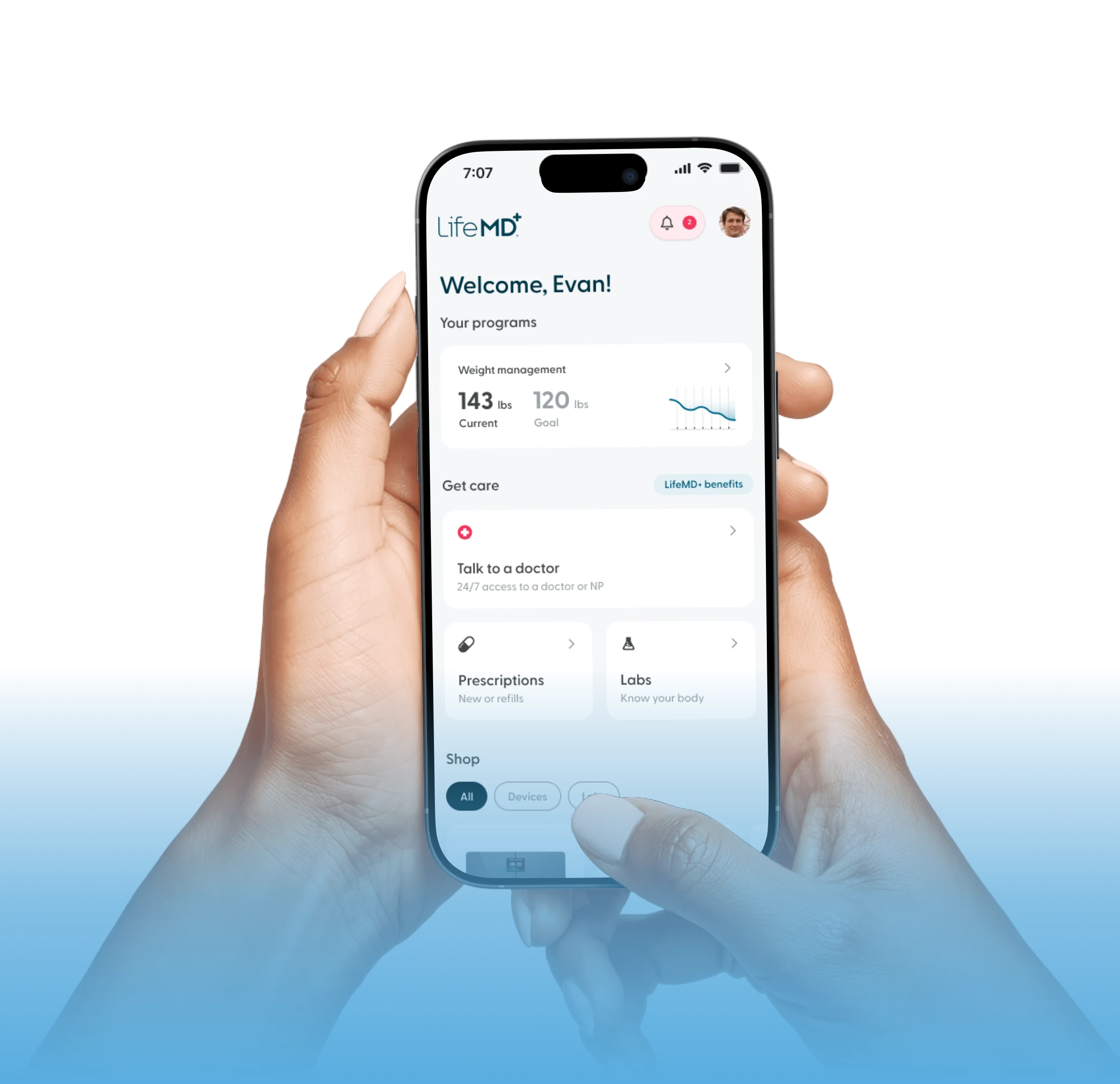

At LifeMD, a dedicated team of healthcare professionals wants to help you take care of your well-being.

We offer a range of services, including consultations with licensed doctors, ordering lab tests, getting certain prescription drugs, and access to a world-class Weight Management program.

Make an appointment with LifeMD today to get the healthcare you need, all from the comfort of your own home.