Understanding Telehealth Insurance Coverage

Telehealth is definitely one of the newer conveniences we have due to the pandemic. But even after being able to go see a doctor in person, many of us have latched on to the idea of getting our check-ups, refilling our prescriptions, and asking our doctor’s questions via video call.

And that’s because it’s so easy and convenient!

While telehealth services have benefitted both providers and patients for convenience reasons, the issue of cost has always impacted the American healthcare system. But as commercial insurances have started to cover the costs of telemedicine, it may become an option for even more people.

In this article, we’ll help you understand the connection between telehealth services and insurance coverages, and how to maximize your experience with telehealth.

What is Telehealth?

Telehealth refers to the use of digital communication technologies to access and deliver healthcare services remotely.

This could include virtual consultations, remote monitoring of vitals, online prescription refills and more.

These virtual services allow patients to receive medical care and advice from licensed healthcare professionals without the need to get in the car and drive to the doctor’s office and wait in a waiting room for long periods of time for an appointment that could be shorter than the time it took to get there.

This not only makes the experience for the patients more convenient, but it can make healthcare accessible for those who live in remote or underserved areas.

The Basics of Telehealth Insurance Coverage

Telehealth insurance coverage typically includes a variety of services that can be delivered remotely.

This involves appointments with healthcare providers conducted via video calls, phone calls, or secure messaging platforms. Patients can discuss their symptoms, receive diagnoses, and get treatment recommendations without physically visiting a medical facility.

Some insurance plans cover remote monitoring services where patients can use wearable devices or mobile apps to track their vital signs, such as heart rate, blood pressure, or blood glucose levels. Healthcare providers can remotely monitor these data and provide guidance or intervention when necessary.

Many insurance plans cover telehealth services that allow patients to request prescription refills or receive new prescriptions electronically through virtual consultations with healthcare providers.

Telehealth coverage often extends to mental health services, including therapy sessions, counseling, and psychiatric consultations conducted remotely.

Patients with chronic conditions such as diabetes, hypertension, or asthma may benefit from telehealth services for ongoing monitoring, education, and management of their conditions.

Telehealth insurance coverage may include access to specialist consultations, allowing patients to seek expert opinions and treatment recommendations without traveling long distances.

It's important to note that the specific telehealth services covered may vary depending on the insurance provider and the terms of the insurance plan.

Understanding copays, deductibles, and coinsurance

When using telehealth services covered by insurance, patients may still be responsible for certain out-of-pocket costs, including copays, deductibles, and coinsurance. Here's what these terms mean:

Copay: A copay is a fixed amount that patients are required to pay for each telehealth visit or service covered by their insurance plan. For example, a telehealth consultation may have a copay of $30, meaning the patient would pay $30 for each virtual visit.

Deductible: A deductible is the amount that patients must pay out of pocket before their insurance coverage kicks in. For telehealth services, patients may need to meet their deductible before their insurance starts covering a portion or all of the costs.

Coinsurance: Coinsurance is the percentage of the cost of a telehealth service that patients are responsible for paying after meeting their deductible. For instance, if a patient's insurance plan has a 20% coinsurance for telehealth services, the patient would be responsible for paying 20% of the total cost of each covered telehealth visit, while the insurance would cover the remaining 80%.

Understanding these financial aspects of telehealth insurance coverage is essential for patients to anticipate and budget for any out-of-pocket expenses associated with using telehealth services.

Different types of insurance plans and their coverage of telehealth

Telehealth coverage can vary depending on the type of insurance plan that a patient has. Common types of insurance plans include:

Health maintenance organization (HMO): HMO plans typically require patients to choose a primary care physician (PCP) and obtain referrals from their PCP to see specialists. Telehealth services covered by HMO plans may be limited to in-network providers, and patients may need to follow specific procedures to access telehealth benefits.

Preferred provider organization (PPO): PPO plans offer more flexibility in choosing healthcare providers, both in-network and out-of-network, without requiring referrals from a PCP. Telehealth coverage under PPO plans may include a broader range of providers, but patients may still have to adhere to network guidelines for coverage.

Exclusive provider organization (EPO): EPO plans combine aspects of HMO and PPO plans, offering coverage for in-network providers only but without requiring referrals from a PCP. Telehealth services covered by EPO plans may be limited to in-network providers, similar to HMO plans.

Point of service (POS): POS plans allow patients to choose between in-network and out-of-network providers, with varying levels of coverage depending on the provider chosen. Telehealth coverage under POS plans may follow similar guidelines to PPO plans, offering flexibility in provider choice.

High-deductible health plan (HDHP) with health savings account (HSA): HDHPs typically have higher deductibles and lower premiums compared to other plans. Telehealth services may still be covered under HDHPs, but patients may need to meet their deductible before insurance coverage applies, and they may have the option to use funds from an HSA to pay for telehealth expenses.

Patients should review their insurance plan documents or contact their insurance provider to understand the specific telehealth coverage offered under their plan and any associated costs or restrictions.

What Factors Affect Telehealth Insurance Coverage?

There are several factors that can affect telehealth insurance coverage. Coverage impacts the extent to which telehealth services are reimbursed and accessible to patients.

State regulations and policies

State regulations can significantly affect telehealth insurance coverage. These regulations vary from state to state and can impact various aspects of telehealth services, including reimbursement, licensure, practice standards, and coverage mandates.

For example, some states mandate that private insurers reimburse healthcare providers for telehealth visits at the same rate as in-person visits, while others leave reimbursement rates to the discretion of insurers.

Additionally, states may establish standards of practice for telehealth, such as requirements for patient consent, documentation, and privacy.

Compliance with these standards may be necessary for providers to receive reimbursement for telehealth services from insurers.

Insurance provider policies

Insurance provider policies also influence telehealth coverage. Insurers establish their policies regarding coverage criteria, network requirements, reimbursement rates, authorization processes, and telehealth platforms or providers partnered with the insurer.

These policies determine which telehealth services are covered, how much patients may need to pay out-of-pocket, and which healthcare providers patients can access through telehealth.

Reimbursement mechanisms, such as fee-for-service models or bundled payments, further shape provider participation and patient access to telehealth.

Types of telehealth services covered

The types of telehealth services covered by insurance plans, patient eligibility criteria, benefit designs, and government programs and policies – such as Medicaid and Medicare reimbursement rules – also impact telehealth insurance coverage.

Typically, telehealth services include virtual consultations, allowing patients to connect with healthcare providers for medical advice, diagnosis, treatment planning, and follow-up care via video calls, phone calls, or secure messaging platforms.

Remote monitoring utilizes digital devices, sensors, or mobile applications to collect and transmit patient health data for monitoring chronic conditions such as diabetes, hypertension, or heart disease. Mental health services – including therapy sessions, counseling, and psychiatric consultations – are often accessible remotely, reducing barriers to treatment and stigma associated with seeking mental healthcare.

Telehealth supports the ongoing management of chronic diseases by enabling patients to receive education, monitoring, and support from their healthcare providers remotely, improving health outcomes and patient engagement.

While not all insurance plans carry the same policies for these services, it's essential for patients to review their insurance policy documents, contact their insurance provider, or consult with their healthcare provider to understand the specific telehealth services covered under their plan and any associated costs or restrictions.

How Do You Know If Your Insurance Covers Telehealth?

To find out if your insurance covers telehealth, contact your insurance provider directly. You can find the contact information on your insurance card through their website. Be sure to ask them specifically about their telehealth coverage policies, including:

Which services are covered

Whether there are any limitations or restrictions

If there are any specific requirements for accessing telehealth benefits

Even if telehealth services are covered by your insurance, you may still be responsible for certain out-of-pocket costs. These can include copayments, deductibles, and coinsurance. Make sure to understand how these costs apply to telehealth visits and whether they differ from in-person visits. Ask your insurance provider about any cost-sharing requirements for telehealth services under your plan.

Many insurance plans have networks of preferred healthcare providers, and using in-network providers often results in lower out-of-pocket costs for patients. When seeking telehealth services, check whether your insurance plan has a network of telehealth providers.

You can usually find this information on your insurance provider's website or by contacting their customer service. If you have a specific healthcare provider you prefer, ask if they are in-network for telehealth services under your plan or if there are any designated telehealth providers you should use to ensure coverage.

By following these steps and being proactive in understanding your insurance coverage for telehealth, you can ensure that you are informed about your options and can access telehealth services with confidence and clarity about any associated costs.

Tips for Maximizing Telehealth Insurance Coverage

Many insurance plans cover preventative care services through telehealth, such as annual check-ups, screenings, and immunizations. Take advantage of these services to stay proactive about your health and prevent potential health issues.

By utilizing telehealth for preventative care, you not only save time and money but also potentially catch health concerns early, leading to better health outcomes in the long run. Be sure to check with your insurance provider to confirm which preventative care services are covered through telehealth under your plan.

To ensure smooth reimbursement for telehealth services, it's essential to keep thorough records of your telehealth appointments and related documentation. This includes keeping copies of appointment confirmations, receipts, visit summaries, prescriptions, and any other relevant documentation.

These records may be necessary when submitting claims to your insurance provider for reimbursement or for verifying telehealth services rendered. By maintaining organized records, you can streamline the insurance claims process and maximize your coverage for telehealth services.

Challenges and Considerations of Telehealth

It’s important to understand when telehealth is an appropriate option, and when you should seek medical care in person.

Limited coverage

Telehealth is suitable for various non-emergency medical concerns – including minor illnesses, chronic disease management, mental health counseling, medication management, and follow-up appointments.

However, for conditions requiring in-person evaluations or procedures, it’s best to make the trip to your doctor’s office. In the case of emergencies, seek medical attention immediately at your nearest urgent care or hospital.

Technological barriers

Access to telehealth services can be limited by technological barriers, such as lack of high-speed internet access, digital literacy, or availability of compatible devices.

Patients in rural or underserved areas may face challenges accessing telehealth due to inadequate infrastructure.

Healthcare providers must consider patients' technological capabilities and offer alternatives, such as telephone consultations, to ensure equitable access to care.

Privacy and security concerns

Telehealth raises privacy and security concerns related to the transmission and storage of sensitive health information. Patients may worry about the confidentiality of their medical data during virtual consultations or remote monitoring.

Healthcare providers must adhere to strict standards for data encryption, authentication, and secure communication platforms to protect patient privacy. Patients should also verify that telehealth platforms comply with relevant privacy regulations – such as HIPAA – to safeguard their personal health information.

Where Can You Learn More About Telehealth?

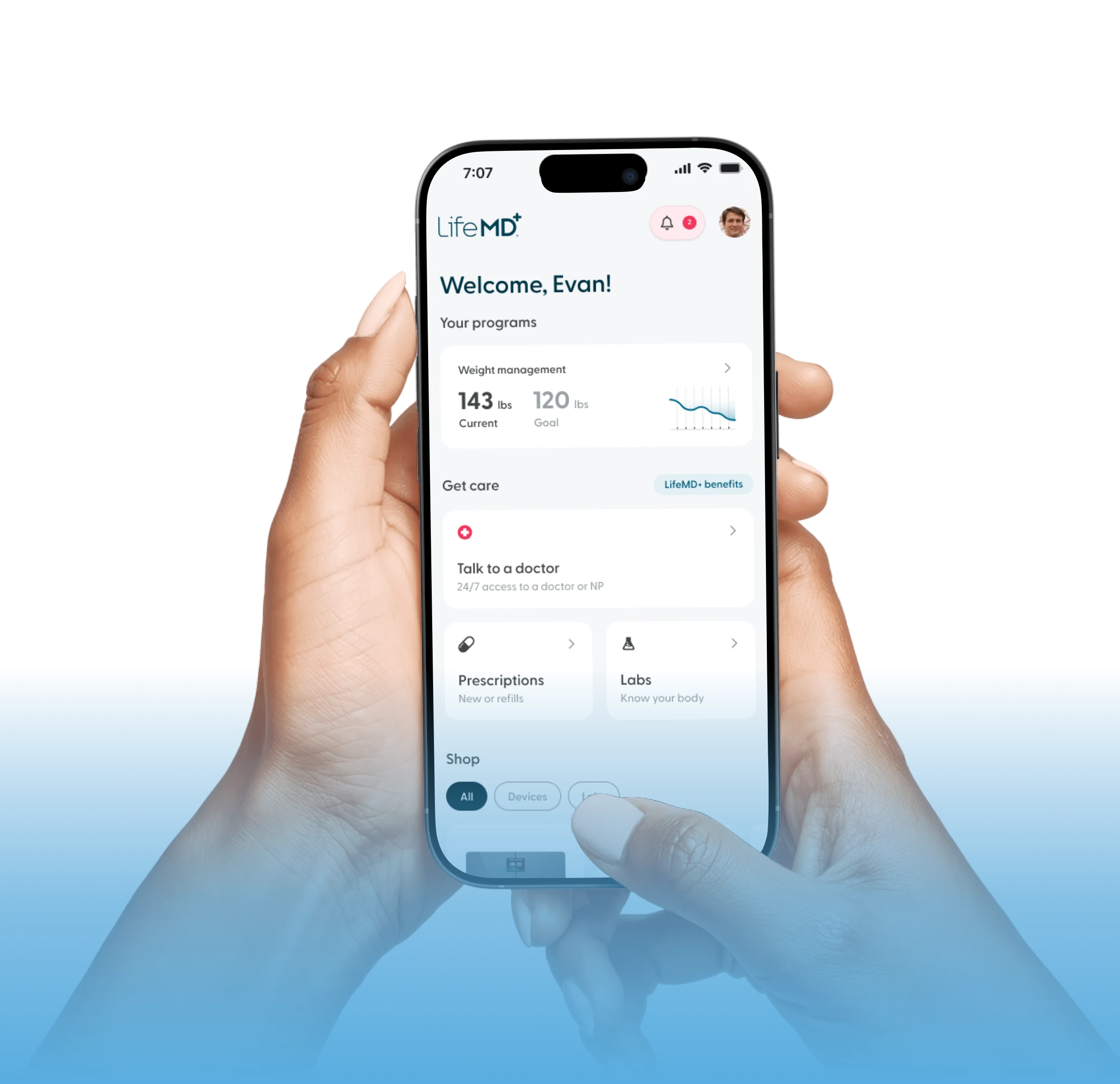

LifeMD is a leading telehealth platform that offers its members on demand video visits with a doctor, 24/7 messaging with your LifeMD care team, 90% savings on lab orders and prescription medications, and transparent pricing.

With tiered pricing plans, members pay for the care they want, on their terms. Treating conditions like UTIs, insomnia, diabetes, asthma, and more, LifeMD is dedicated to providing personalized care to people across all 50 states.

It starts with just a click of a button. To learn more about LifeMD, and to find out how your insurance coverage can help you gain access to amazing healthcare, make an appointment today.