The Benefits of Insurance When Using Telehealth

Telehealth has become more of a standard for getting care in the U.S. From easy-to-schedule video check-ups to quick text chats to refill prescriptions, the convenience of telehealth has made it a leading choice for those of us looking to keep our health in-check.

But just as the costs add up in traditional healthcare settings, the same can be true with telehealth. That’s why it’s so important to have insurance coverage – whether it be a commercial insurance plan or federally or state funded – to help reduce the costs of telehealth services.

In this article, we’ll outline how having insurance can help you get the care you need conveniently through telehealth services – and better yet – without breaking the bank.

Cost Savings for Patients

Having insurance coverage can significantly contribute to saving money when using telehealth services. Insurance provides financial protection by mitigating out-of-pocket expenses associated with telehealth consultations and services.

With insurance coverage, patients typically have copayments, deductibles, and coinsurance that they are responsible for, but these costs are often lower than paying for healthcare services entirely out-of-pocket.

Insurance plans negotiate rates with healthcare providers – including telehealth platforms – which can result in discounted rates for covered services compared to what you might pay without insurance.

Additionally, insurance networks often have partnerships with telehealth platforms or specific providers, allowing you to access telehealth services at reduced rates or with enhanced coverage options.

In-network providers may offer discounted rates for telehealth visits, making it more affordable for you to seek care remotely. Insurance plans may even have special benefits or incentives for using telehealth services – such as waived copayments or reduced coinsurance – incentivizing patients to utilize telehealth for their healthcare needs.

Insurance coverage also ensures continuity of coverage for telehealth services, integrating telehealth into existing insurance plans and offering consistent coverage for both in-person and remote care.

This means that you can access telehealth services without worrying about whether they are covered by their insurance. This can give you that extra peace of mind and encourage the use of telehealth for routine needs.

Insurance plans may cover preventive telehealth services, such as virtual check-ups, screenings, and counseling, which can help identify health issues early and prevent costly complications down the line.

By promoting preventive care and early intervention, insurance coverage for telehealth contributes to long-term cost savings by reducing the need for more expensive treatments and hospitalizations.

Cost savings beyond health services

Besides the reduced prices that insurance coverage may offer for telehealth services, there are other opportunities for saving money when taking advantage of telehealth.

For one, with telehealth you won’t have to leave your couch, so consider any money spent on gas or public transportation to get to the doctor’s office money in your pocket.

If you’re a parent who isn’t able to bring your child with you to your appointment, or if your appointment time interferes with a school pick-up you’d probably have to pay for child care to make sure you made it to your appointment.

The convenience of telehealth allows you to save some extra money since you can take an appointment from wherever you are. An added plus is that you don’t have to schedule you or your family’s entire day around your healthcare appointment.

Increased Access to Healthcare

Having insurance coverage can significantly contribute to saving money when utilizing telehealth services by enhancing access to healthcare in various ways.

Firstly, insurance coverage helps overcome geographical barriers that may otherwise limit access to healthcare services. Telehealth allows you to connect with healthcare providers remotely, regardless of their location.

With insurance coverage, you can access telehealth services from the comfort of your home, eliminating the need for travel to medical facilities. This not only saves on transportation costs but also reduces the time and inconvenience associated with commuting to appointments, particularly for individuals residing in rural or underserved areas where healthcare facilities may be scarce.

Insurance coverage plays a crucial role in improving access to telehealth services for underserved populations. Many individuals – especially those from low-income or marginalized communities – may face barriers to accessing traditional healthcare services due to factors such as lack of transportation, limited mobility, or financial constraints.

Insurance coverage for telehealth ensures that these populations have equitable access to medical care by providing coverage for virtual consultations and remote monitoring services.

This helps bridge the gap in healthcare access and promotes health equity by ensuring that everyone – regardless of their socioeconomic status or geographic location – can receive timely and necessary medical care.

Additionally, insurance coverage facilitates timely access to care, which is essential for addressing health concerns promptly and preventing the progression of illnesses or chronic conditions.

Telehealth allows you to connect with healthcare providers on-demand, reducing wait times for appointments and enabling timely medical intervention when needed.

This proactive approach to healthcare can lead to better health outcomes, reduced healthcare costs in the long term, and improved overall well-being for individuals and communities.

Improved Health Outcomes

Insurance coverage for telehealth services not only contributes to cost savings but also leads to improved health outcomes by promoting proactive healthcare practices and facilitating timely interventions.

Insurance coverage encourages regular preventive care through telehealth services. While it may seem like a hassle to get up and go to the doctor’s office throughout the year even when you don’t need to, checking in via video call with a doctor from your couch doesn’t seem as difficult or time consuming.

Many insurance plans cover preventive care visits conducted via telehealth, such as annual check-ups, and screenings. By removing financial barriers to accessing preventive care, insurance motivates patients to schedule regular telehealth appointments to monitor their health status and detect any potential issues early on.

This emphasis on prevention helps you maintain optimal health, identify risk factors for chronic conditions, and prevent the development of more serious health problems in the future.

Insurance coverage enhances patient engagement and adherence to treatment plans through telehealth services. Patients who have insurance coverage for telehealth are more likely to actively participate in their healthcare management by attending virtual appointments, adhering to medication regimens, and following treatment recommendations provided by their healthcare providers.

Telehealth platforms often offer features such as appointment reminders, medication alerts, and secure messaging capabilities, which promote ongoing communication between patients and providers and support patient engagement in their care.

Additionally, insurance coverage for telehealth enables individuals to address health concerns in a timely manner, leading to better health outcomes. Telehealth services offer convenient access to healthcare providers, allowing patients to seek medical advice and treatment promptly without waiting for in-person appointments.

With insurance coverage, you can access telehealth services without worrying about the cost, making it easier to address minor health issues or seek guidance on managing chronic conditions before they escalate into more serious problems. Timely interventions through telehealth help individuals receive the care they need when they need it, reducing the risk of complications, hospitalizations, and adverse health outcomes.

By promoting proactive healthcare practices and ensuring access to high-quality telehealth services, insurance contributes to better health outcomes, increased patient satisfaction, and a more efficient healthcare system overall.

Support for Mental Health and Well-being

Let’s face it. Sitting in a therapist’s office and diving into your intimate thoughts and feelings is an intimidating feat for anyone. And we’ve all heard how unaffordable it can be to get the mental health support you need.

Insurance coverage for telehealth services offers valuable support for mental health and well-being by providing convenient access to mental health services, reducing the stigma associated with seeking mental healthcare, and offering support for individuals managing mental health conditions.

Telehealth services covered by insurance plans offer convenient access to mental health services, making it easier for individuals to seek help when they need it. Many people may face barriers to accessing traditional mental health services, such as long wait times for appointments, limited availability of providers, and logistical challenges related to transportation or scheduling.

Telehealth removes these barriers by allowing you to connect with mental health professionals remotely, often through video calls or secure messaging platforms. Not only is this convenient, but having these difficult conversations from the comfort of your own home can definitely loosen you up and help you feel safe.

With insurance coverage, you may have access therapy sessions, counseling, and psychiatric consultations from the comfort and privacy of their own homes, eliminating the need for travel and reducing logistical hurdles to seeking mental healthcare.

Moreover, insurance coverage for telehealth helps reduce the stigma associated with seeking mental healthcare by offering discreet and confidential options for receiving support.

Many people may hesitate to seek help for mental health concerns due to fear of judgment, embarrassment, or social stigma. Telehealth services provide a more accessible and private alternative to traditional in-person therapy, allowing individuals to receive mental health support without having to disclose personal information or concerns to others.

By offering a confidential space for seeking help, telehealth helps normalize conversations about mental health and encourages individuals to prioritize their well-being without fear of judgment or stigma.

Additionally, insurance coverage for telehealth provides essential support for individuals managing mental health conditions by ensuring ongoing access to care and support services.

Telehealth platforms enable individuals to connect with mental health professionals for regular therapy sessions, medication management, crisis intervention, and other support services, even when face-to-face appointments may not be feasible.

With insurance coverage, you can receive the necessary support and treatment for managing mental health conditions, leading to improved symptom management, enhanced coping skills, and better overall well-being.

By making mental healthcare more accessible, confidential, and supportive, telehealth services help individuals prioritize their mental health and lead healthier, more fulfilling lives.

Compliance with Healthcare Regulations

Compliance with healthcare regulations is paramount in ensuring the legality, security, and efficiency of telehealth services covered by insurance plans.

Insurance coverage for telehealth services ensures compliance with state and federal telehealth laws. These laws govern the practice of telehealth, including licensure requirements for healthcare providers, patient consent, prescribing regulations, and telehealth practice standards.

Insurance plans that cover telehealth services must adhere to these laws to ensure that patients receive care from licensed and qualified providers, and that telehealth services are delivered in a manner consistent with legal requirements.

Insurance coverage for telehealth ensures adherence to privacy and security standards for patient data.

Telehealth platforms must comply with regulations such as the Health Insurance Portability and Accountability Act (HIPAA), which set forth strict guidelines for the protection of patient health information.

Insurance plans must select telehealth platforms that meet HIPAA requirements and implement robust data encryption, authentication, and access controls to safeguard patient privacy and security during telehealth consultations.

Insurance coverage for telehealth facilitates documentation and billing processes for healthcare providers, streamlining administrative workflows and ensuring reimbursement for telehealth services.

Telehealth encounters must be properly documented and billed to insurance companies in accordance with applicable coding and billing regulations.

Insurance plans that cover telehealth services provide guidance and resources to healthcare providers on documentation requirements, coding guidelines, and billing procedures for telehealth visits, ensuring accurate reimbursement and compliance with insurance policies and regulations.

Where Can You Learn More About Telehealth?

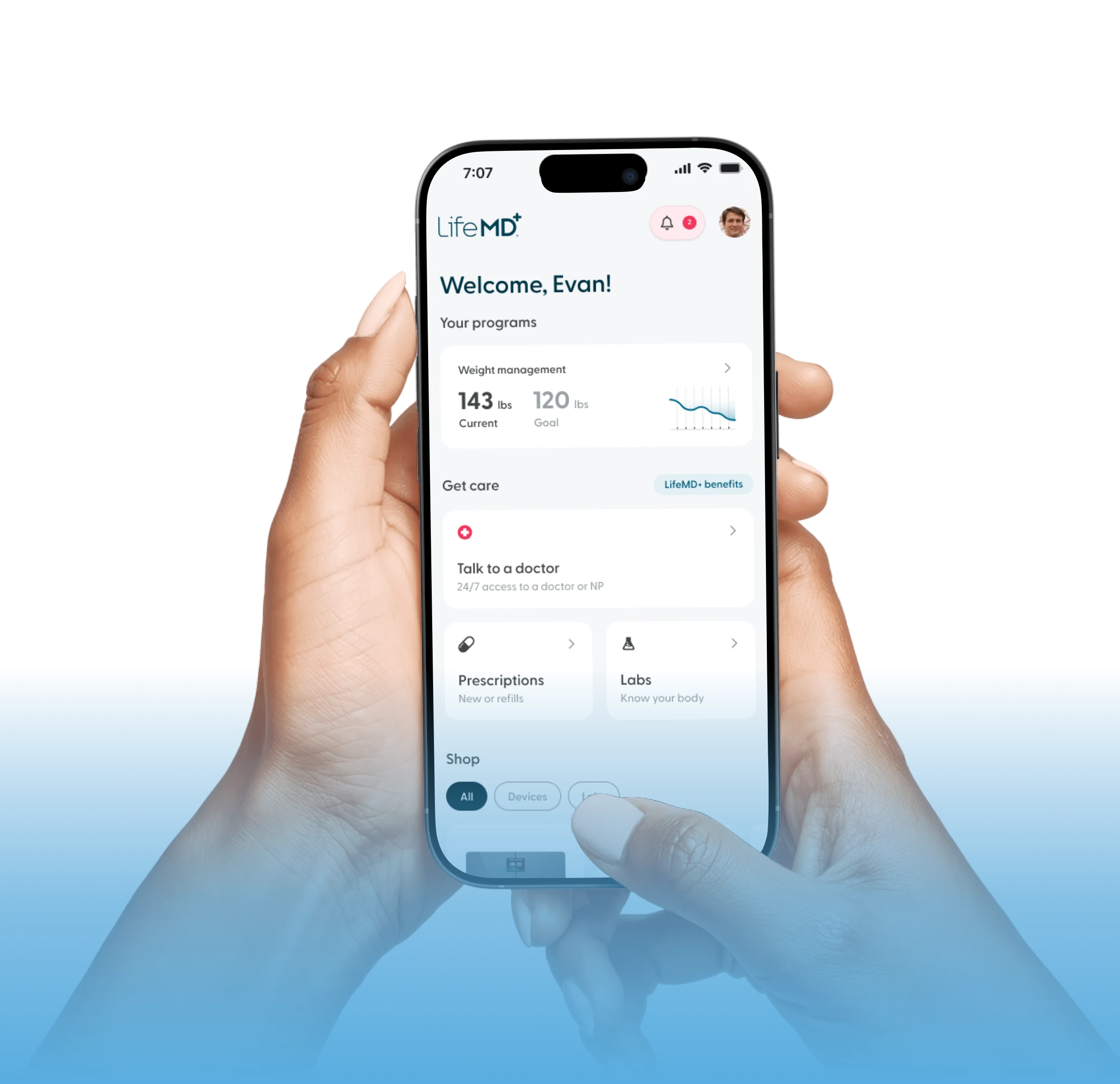

LifeMD is a leading telehealth platform that offers its members on-demand video visits with a doctor, 24/7 messaging with your LifeMD care team, 90% savings on lab orders and prescription medications, and transparent pricing.

With tiered pricing plans, members pay for the care they want, on their terms. Treating conditions like UTIs, insomnia, diabetes, asthma, and more, LifeMD is dedicated to providing personalized care to people across all 50 states.

It starts with just a click of a button. To learn more about LifeMD, and to find out how your insurance coverage can help you gain access to amazing healthcare, make an appointment today.