Tips for Getting the Best Deal: Health Insurance vs. Prescription Drug Plans

Unfortunately, the cost of prescription medication is a common barrier to treatment. While most U.S. citizens may have health insurance, coverage varies depending on your plan. Sudden health complications may come with unexpected costs. However, there are many avenues you can take to cover prescription medication costs and save time at the pharmacy.

Health insurance can be a nuisance to deal with while being stressed out about your health. Still, there are ways to navigate the system while putting money back into your pocket. Each health insurance plan has a formulary (list of drugs an insurance company is willing to cover). However, health coverage doesn’t always equate to prescription drug coverage. Depending on your needs, this can affect how much you pay at the pharmacy.

What is Prescription Drug Insurance?

Prescription drug plans are not exactly the same as health insurance plans. Prescription drug insurance covers the costs of prescription drugs only and is a part of health insurance coverage.

Medicare from the U.S. government currently offers a drug plan, and most private health insurance companies offer one as well. You can opt for a Part D prescription drug card. Part D prescription plans are optional coverage offered by both private health insurance and Medicare.

You can also receive prescription drug coverage from your state. However, coverage may vary depending on where you live.

When it comes to prescription drug plans from an insurer, they categorize medication in tiers based on their availability and cost. With Medicare, tier 1 includes the most generic versions of medications with the lowest copayment. More expensive and branded medications are in tiers two to four.

Healthcare providers can work with insurance plans to potentially help you get money off a required medication that may be more expensive.

What is Health Insurance?

Health insurance plans from employers have a unique setup that may not be easy to understand. The most important components of an insurance plan to know are the premium, deductible, and out-of-pocket expenses.

Most people start paying for their health insurance when they turn 26. Typically, parents are paying the premium on health insurance for their kids up until that point. The premium is the base amount you pay to have the health insurance of your choice. Keep in mind that having health insurance doesn’t guarantee prescription coverage depending on your plan.

The deductible is the amount of money the insured person is expected to cover before health insurance chips in. The amount you pay, including the copay (fixed amount to pay when you see a healthcare provider) not covered by insurance, is your out-of-pocket expenses.

When you choose a primary healthcare provider, be sure to find one that is in-network. In-network healthcare providers will accept your form of health insurance. Otherwise, a healthcare provider will require you to pay out-of-pocket costs for doctor's visits.

What is the Difference Between Private and Public Health Insurance?

Most people in the U.S. get private health insurance through their employer. An employer often allows you to pay for your health insurance with your paycheck.

Still, there are options to purchase insurance directly from health insurance companies if your employer doesn’t offer it or you prefer a different option. If you need assistance, the U.S. offers Medicare as a form of public insurance. Medicare drug plans and others do not always cover drugs in hospital outpatient settings.

Many private health insurance companies operate with the expectation that the insured will use their coverage for preventative care. One barrier to access to private insurance coverage is that sometimes companies may deny you coverage if you have certain preexisting health conditions.

Another major difference between public and private insurance is that there is no cap on income when it comes to private insurance. Paying a higher premium leads to more healthcare benefits. While public insurance is more affordable, you may be more likely to experience long waits from providers.

What Happens If Your Insurance Changes?

Private insurance options are often attached to an employer. If you leave a job, the cost of your medications may change, and your prescription insurance coverage will go away as well.

During that time, medications may also be delayed as your coverage adjusts to a different carrier. For retirees, your former employer may let you keep the health insurance you had with the company and continue to have prescription drug coverage. Be sure to double-check with your provider on whether you can keep your coverage before your last day.

Key Point: Can You Get Prescription Coverage Without a Form of Health Insurance?

You have to have some type of health insurance coverage to get a prescription drug plan. Even the Medicare prescription drug plan requires a Medicare or Medicaid Advantage plan. However, some health insurance plans may cover doctor visits, but not prescriptions.

What is the Difference Between Health and Prescription Insurance Cards?

Whichever form of health insurance coverage you have, carry your health insurance card with you at all times in case it’s needed at your pharmacy. Some insurance companies require renewing your insurance card yearly.

The main difference between private insurance cards and public insurance cards is that you can use a private insurance card to cover costs during or right after a doctor’s or hospital visit. Typically, prescription drug plans only cover medications picked up at a pharmacy.

Prescription drug plans also only cover major vaccines like flu, pneumonia, and hepatitis B, while private insurance companies tend to cover more.

Those with private health insurance are likely to have one health insurance card that covers doctor’s visits and prescription costs. However, if you use Medicaid, you are more likely to have a separate card (a Part D prescription card) for prescription medication cost coverage only. In this case, you should carry both cards with you at all times.

How to Read Your Insurance Card

Once you pick your insurance plan, there still may be confusing acronyms on your insurance card. Common acronyms you may see and their meanings are as follows:

Group number and member ID: A doctor’s office or pharmacist may ask you for this to process transactions.

PCN: Some insurance cards have process control numbers (PCNs) to help identify your plan.

BIN: BIN stands for bank identification number. This number lets pharmacists know which prescription plan from your insurance company receives the claim for your medication.

Tips for Getting Medication for the Lowest Cost Possible

1. Always discuss additional options if insurance doesn’t cover medication

Instead of paying the full cost of a medication, let a healthcare provider know if a prescription is not covered by your insurance when you show up at the pharmacy. They can reach out to a healthcare provider for an exception if it’s a medication essential for your health.

2. If there’s a gap in coverage, look into assistance programs

Patient assistance programs and manufacturer copay programs exist to help patients pay for medication.

3. Ask about medication discounts

Some medications and pharmacies have discounts for medications as well. If possible, ask a pharmacist or research what may be available. In some cases, your doctor’s office may know of discounts for common medications.

4. Don’t leave if you forget your insurance card

You can still get your medication covered if you forget your insurance card. Some insurance companies have apps where you can access your card virtually. Keep in mind that if you have Medicaid, you may have to carry two cards instead of one.

5. Keep track of insurance cards for dependents

If you have healthcare coverage from the government, you will have separate health insurance cards for dependents. Make sure to keep them in a safe place for prescription coverage.

Is Weight Loss Care Covered by Health Insurance?

Generally, medical insurance covers doctor visits, hospital stays, and other medical services, while prescription insurance covers the cost of medications.

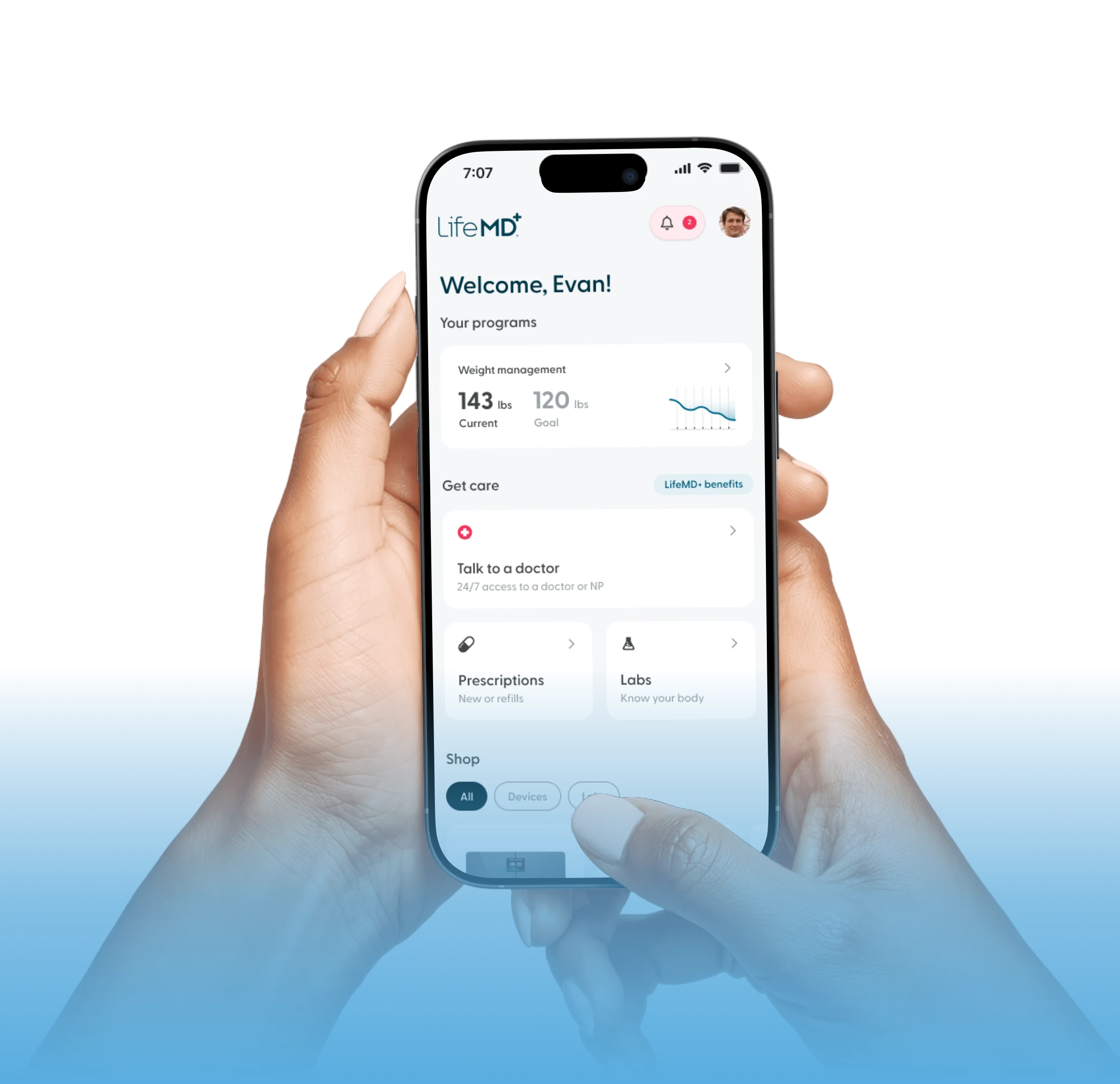

Telehealth platforms like LifeMD run a benefits check to understand your prescription drug coverage. Still, some prescription benefits may require prior authorization (PA) before they can cover the cost of GLP-1 medications.

Prior authorization is a process where your healthcare provider contacts your insurer to verify that you need a certain medication. This process is often enacted to ensure those who really need expensive medication coverage receive the support they need from insurance.

Patients with eligible medical insurance plans may have in-person or virtual visits with a medical provider covered by their insurance. LifeMD works with various insurers in different states to ensure you have as many options as possible for care. Partnerships will continue to expand across the country.

Where Can I Learn More About Insurance Coverage?

LifeMD works with insurance companies to get you the best possible coverage for select medications. Learn more about LifeMD medications you can order from the comfort of your home.