An Essential Guide on How to Apply for Medicare

Applying for Medicare can feel overwhelming, especially when you’re faced with numerous forms, deadlines, and different coverage options.

However, you should understand how the enrollment process works to avoid delays or gaps in essential medical services.

In this article, we’ll guide you through everything you need to know about signing up for Medicare, including expert-approved tips to ensure a smooth enrollment process.

What is Medicare and How Does it Work?

Medicare is a national health insurance program that covers certain medical expenses for U.S. citizens older than 65 and younger people with disabilities and chronic conditions.

The program is divided into four parts that each cover a different aspect of healthcare:

Part A (Hospital Insurance): Covers inpatient hospital stays, care in skilled nursing facilities, hospice care, and certain home health care services.

Part B (Medical Insurance): Covers certain doctors' services, outpatient care, medical supplies, and preventive services.

Part C (Medicare Advantage plans): Offers an alternative way to receive your Medicare benefits through private health insurance companies approved by Medicare.

Part D (Prescription drug coverage): Helps cover the cost of prescription drugs.

For a more detailed explanation of Medicare coverage, read our comprehensive guide.

Which Documents Will I Need to Sign Up for Medicare?

When applying for Medicare, you’ll need to submit several important documents to prove your eligibility and ensure a smooth application process.

These documents include:

Social Security card: To verify your Social Security Number (SSN), which is essential for processing your Medicare application.

Birth certificate or passport: These documents are required to prove your age and U.S. citizenship or legal residency. If you were born outside of the U.S., you might need additional documents — such as a Naturalization Certificate or Green Card — to prove your right to live in the country.

Proof of residence: Utility bills, lease agreements, or mortgage statements can be used as proof of where you live, especially if your current address differs from addresses listed on your identity documents.

Employment and income information: If you or your spouse are still working, bring copies of your W-2 forms or tax returns from the last two years. This information is used to determine if you are eligible for premium-free Medicare Part A.

Proof of current health insurance: If you are covered under a group health plan through your or your spouse’s current employment, you’ll need documentation to prove it. This is important for determining how your Medicare coverage will work with other insurance.

Try to gather these documents before you start the application to help it go as quickly as possible and avoid any delays.

How to Apply for Medicare: A Step-by-Step Guide

There are various ways to apply for Medicare, depending on whether you receive Social Security benefits and how old you are. Let’s take a closer look at the application process.

If you’re receiving Social Security benefits

If you’re already receiving Social Security retirement benefits, you’ll be automatically enrolled in Medicare Parts A and B when you turn 65.

This means that you don’t need to apply to be part of the health insurance scheme.

If you don’t want to be enrolled in Medicare Part B — which covers expenses like doctors’ visits, preventative screenings, and vaccines — you can follow the instructions provided with your insurance card to decline the coverage.

If you’re not getting Social Security yet

Individuals who are not yet receiving Social Security benefits will need to sign up for Medicare manually. There are a few ways to do this.

Complete an online application

Applying online is often the quickest and most convenient way to enroll in Medicare. Follow these steps to apply:

Visit the official website of the Social Security Administration (SSA).

Navigate to the Medicare section and follow the prompts for "Apply for Medicare Only."

You can fill out the application without starting your Social Security retirement benefits.

On the Medicare section of the SSA’s website, you’ll also find various requirements for specific groups of people.

For example, if you have end-stage renal disease (ESRD), you can’t apply online and will have to phone a Social Security representative.

Before applying, check that you meet the requirements and follow the specific instructions for your condition to ensure a smooth process.

Once you’ve submitted your application, you can also check its status to see when you can expect a decision.

Apply in person

If you are unable to apply online, don’t worry. Medicare applications can also be done in person by following these steps:

Locate your nearest Social Security office.

Make an appointment to avoid long wait times.

Bring all the necessary documents, including proof of age, U.S. citizenship or legal residency, and any current health insurance information.

Get an office representative to assist you in filling out the application form.

Your application can take a few weeks to process, so ensure that you apply as soon as possible.

You become eligible for Medicare three months before your 65th birthday or in the month you receive your first Social Security disability benefits check.

Once you are eligible for coverage, you can apply.

Apply by phone

You can also apply for Medicare by phone, but be prepared to wait for a while — especially if the call center is busy. To apply by phone, follow these steps:

Call the Social Security Administration (SSA) at 1-800-772-1213 (or TTY 1-800-325-0778 for the hearing impaired).

Call between 7am and 7pm, Monday through Friday.

Once your call is answered, a representative will guide you through the application process and tell you which documents you need to mail or bring to an office.

If you are disabled and under the age of 65

Medicare is available to younger people who receive Social Security benefits (SSDI).

If you fall into this category, you will usually be enrolled in Medicare automatically after 24 months of becoming eligible for disability benefits from Social Security.

Individuals with chronic conditions — such as Lou Gehrig's disease, kidney failure, or end-stage renal disease — can apply for Medicare within the first month of receiving their disability check.

Coverage will typically start between the first or fourth month of treatment.

Your health plan may also pay for medical costs for up to 12 months before you apply. This is called a retroactive start date.

When Should You Apply for Medicare?

Understanding when to apply for Medicare is crucial to ensure you receive your benefits as soon as you're eligible and to avoid any late enrollment penalties.

There are three key enrollment periods during which you can sign up:

Initial enrollment period

The initial enrollment period (IEP) is your first chance to sign up for Medicare. It begins three months before you turn 65 and ends three months later.

For example, if your 65th birthday is in June, your IEP will begin in March and end in September.

During this period, you can enroll in Medicare Parts A, B, C, and D. If you miss this enrollment period, you may have to pay a late penalty, which we will discuss in more detail later.

Special enrollment period

The special enrollment period (SEP) is available if you or your spouse are working and are covered by a group health plan through your employer.

You can sign up for Medicare Part A and/or Part B at any time, as long as you or your spouse are still working and covered by the group health plan.

Once your employment or coverage ends, the SEP continues for eight more months, during which you can sign up for Medicare.

If you sign up after this time, you will also need to pay a late enrollment penalty.

General enrollment period

If you missed your IEP and aren’t eligible for an SEP, you can sign up for Medicare during the general enrollment period.

This period runs from January 1st to March 31st each year, with coverage starting on July 1st. During this time, you can enroll in Medicare Parts A and B.

Key Point: Understanding Late Enrollment Penalties

Not signing up for Medicare when you're first eligible can result in late enrollment penalties, which are added to your premium for as long as you are a member.

The penalties you may be liable for could include:

-

Part A: If you don't buy or sign up for Part A when you're first eligible, your monthly premium may go up by 10%.

-

Part B: If you don’t sign up for Part B when you're first eligible, your premium may go up 10% for each 12-month period you could have had insurance but didn't sign up. You pay this penalty for as long as you have Part B.

-

Part D: For each month you delay enrollment in Medicare Part D, once you're eligible, you may have to pay 1% of the average national premium as a penalty.

To avoid these penalties, it’s important to know when you will become eligible for Medicare, and you should sign up as soon as you can.

5 Tips for a Smooth Application Process

Apply early

Starting your application process as soon as possible can help prevent any gaps in healthcare coverage.

Applying early also prevents processing delays, which helps you avoid gaps in accessing medical care when you need it.

You can start applying for Medicare three months before your 65th birthday or in the same month that you receive your first disability check.

Keep necessary documents on hand

Have all the required documents — such as your Social Security card, proof of age, and U.S. citizenship or legal residency documentation — organized and ready when you start.

This will ensure a seamless application without any delays.

Ask for help

Always ask for help if you find the application process overwhelming or confusing.

Friends, family members, or a Medicare representative can guide you in filling out your application. You can also contact local senior centers or health insurance counselors for assistance.

Review all of your coverage options

Understand the different parts of Medicare — Parts A, B, C, and D — and decide what coverage you need based on your health and financial situation.

This helps prevent unexpected surprises regarding what your plan does or does not cover, allowing you to avoid unnecessary medical expenses.

Frequently Asked Questions

What happens after you apply for Medicare?

Once you’ve applied for Medicare, you will receive a notification from the SSA about the status of your application.

This can take several weeks, so be patient. Once your application is approved, you'll receive your Medicare card by mail.

How and when will you receive your Medicare benefits?

Your Medicare coverage generally starts the first day of the month you turn 65. If your birthday is on the first of the month, your coverage starts the previous month.

You will receive your Medicare card about three months before your coverage begins. Use this card whenever you receive health care services or prescriptions.

What should you do if you lose your Medicare card?

If you lose your Medicare card, you can request a replacement through the SSA website, or you can call or visit a local SSA office.

It's important to keep your Medicare card safe, as it's your proof of insurance.

What happens if your application is denied?

If your Medicare application is denied, you have the right to appeal the decision. The denial letter you receive will provide detailed instructions on how to appeal.

Where Can I Get the Best Medical Advice and Treatment?

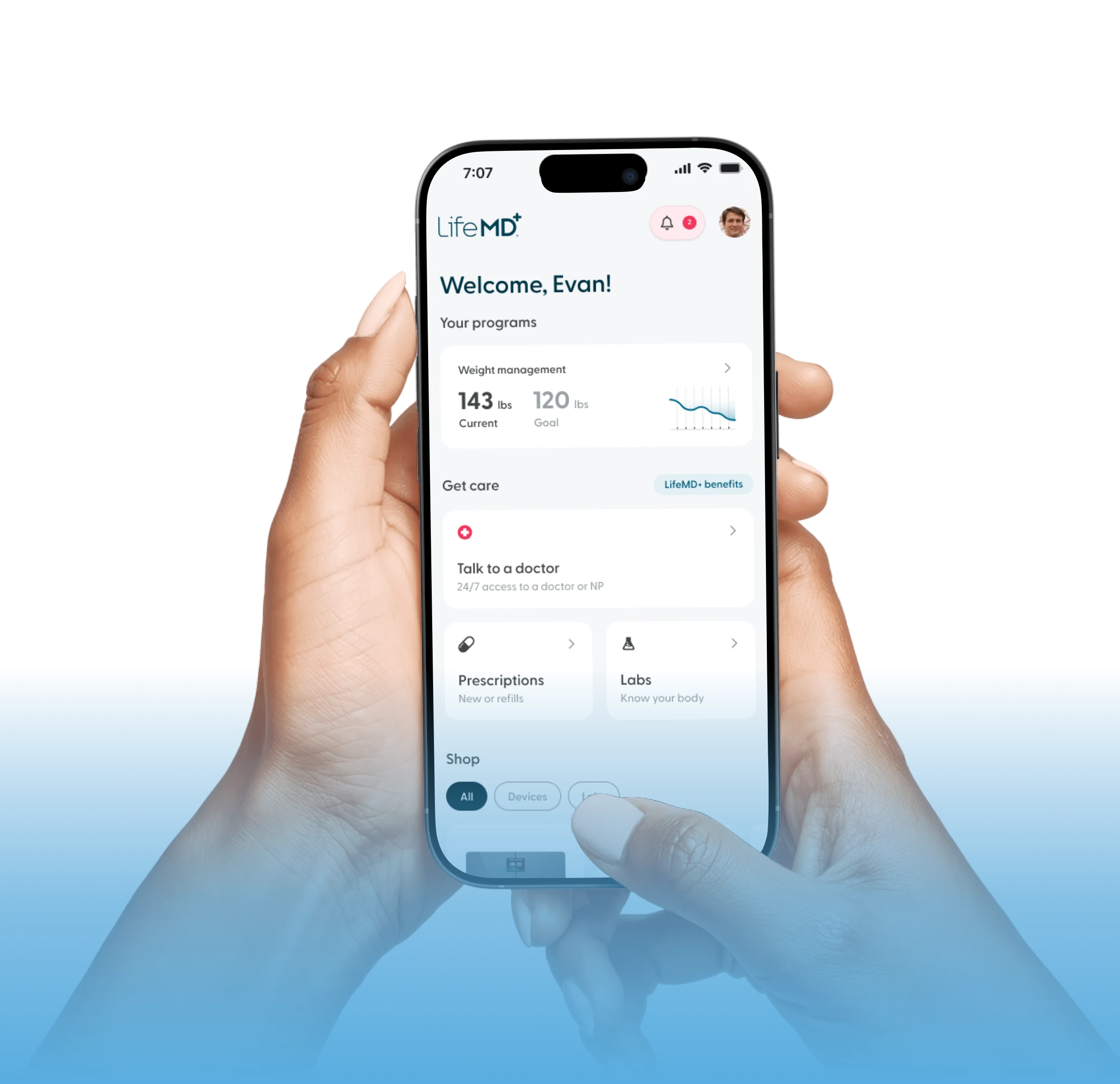

At LifeMD, a dedicated team of doctors and nurse practitioners want to help you care for your well-being.

Through LifeMD, you can consult a healthcare provider who can treat a range of medical conditions and prescribe medications to help you feel better.

Make an online appointment to get started.