Applying for Health Insurance as a Freelancer or Self-Employed Individual

As a freelancer, you often have to juggle multiple responsibilities and face challenges that permanently employed people don’t.

One such challenge is securing your own health insurance.

Unlike formally employed workers — who often have access to employer-sponsored health plans — freelancers must navigate the health insurance landscape independently.

It can be difficult to do this, especially if you’re applying for health insurance for the first time. But you are not alone.

In this article, we’ll explore everything you need to know about navigating health insurance as a self-employed person to help you access high-quality medical care.

Why Do You Need Health Insurance as a Self-Employed Individual?

Health insurance is an essential part of taking care of your well-being and ensuring you have continuous access to various medical services you may need.

Other reasons why you may require health insurance include:

Coverage during emergencies: Health emergencies are unpredictable and can be expensive. Having health insurance helps cover these costs, ensuring you don’t have to use your own money. This can help to protect you from financial strain or delays in receiving urgent medical care.

Managing routine and preventative care: Regular doctor visits and preventative care are key to maintaining your health. Insurance typically covers these services, often with little or no cost to you. This means you can manage your health without worrying about the financial impact of each visit.

Avoiding the high costs of medical services: Medical procedures and treatments can be costly, but health insurance offers reduced rates to members. This means you pay less for the healthcare services you receive.

Legal requirements and penalties: Depending on where you live, it might be a legal requirement to have health insurance. In some cases, failing to have coverage could result in penalties, adding an extra financial burden.

How Do You Choose the Right Health Insurance Plan for Your Needs?

Assess your health status

The first step in choosing your health insurance is to assess your overall health and the medical services you require.

This will help you decide what type of coverage you might need and what essential health benefits to look for in an insurance plan.

Consider any conditions you have that require regular treatment — such as chronic diseases or comorbidities.

If you do have any ongoing health issues, it’s wise to choose a plan that offers comprehensive coverage. This can help you avoid unexpected medical costs.

Do you regularly take prescription medications? If you do, you’ll need to pick a plan that covers any medications you may need.

Determine your budget

Depending on the type of coverage you require, health insurance can become expensive. That’s why it’s important to determine what you can afford before choosing a plan.

Options with a lower monthly premium may seem attractive, but the overall out-of-pocket costs may be higher.

This means that there are more services that aren’t covered by the insurance, which you’ll need to pay for yourself.

On the other hand, plans with a higher premium may offer more comprehensive health insurance coverage with fewer out-of-pocket costs.

Considering how these costs balance out based on your usual health expenses will help you make the right decision.

Compare plans

Once you’ve determined your health needs and your budget, you can start looking at different health insurance plans.

You should research a few different insurance companies to help you get a comprehensive idea of plans you’ll want to consider.

Look at the benefits each plan offers, what’s included in the coverage, and the total cost of each one.

You can also use websites that compare health insurance plans side-by-side to make this step a bit easier.

Decide on your network preferences

Some insurance plans require you to use a list of network providers when you need medical services.

Network providers are a group of healthcare professionals and facilities that have a contract with your health insurance.

They then provide services at a discounted rate to insurance members, depending on the agreement they have with the company.

Your regular doctors may not fall within an insurance plan’s network, which means you’ll have to visit different healthcare providers.

If you have a preferred physician, always check which plans cover their services to avoid any difficulties accessing healthcare.

What are Your Health Insurance Options?

As a freelancer, you might not have access to group health insurance plans like those provided by employers. But you still have a number of options available to you.

Individual insurance plans

These are health insurance policies that you purchase and pay for on your own.

Individual plans usually offer good coverage for various services, including doctor visits, hospital stays, emergency services, and prescriptions.

However, they can also be customized to fit your needs and budget, offering different levels of coverage and additional benefits.

The Health Insurance Marketplace (Affordable Care Act)

Under the Affordable Care Act (ACA), you can purchase health insurance through a federal or state marketplace.

ACA plans typically cover essential medical services, including coverage for preexisting conditions. They also offer preventative services at no extra cost.

These plans are categorized into four levels — Bronze, Silver, Gold, and Platinum — which differ based on cost and coverage.

For example, bronze plans have the lowest health insurance premiums but the highest out-of-pocket expenses, meaning you’ll have to pay for many services yourself.

Platinum plans, on the other hand, have the highest premiums but lowest out-of-pocket costs.

Short-term health insurance plans

These policies are more affordable than traditional insurance plans, but they only offer limited coverage.

Short-term health insurance often excludes coverage for things like prescription medications, preventative care, and treatments for preexisting conditions.

However, they can be useful as temporary medical coverage — especially if you’ve missed an initial deadline for applying for a different plan.

These policies can cover you for any period, ranging from one month to an entire year.

Medicaid or Medicare

You may also qualify for state and government-funded healthcare programs, such as Medicaid and Medicare.

For Medicaid, you must be considered a low-income individual to be eligible. This means you earn much less than the average household in your state.

The necessary amount you’ll have to earn can vary by state, so check the official website for information.

For Medicare, you have to be over the age of 65 or have a disability or chronic condition that requires continuous treatment.

To learn more about these programs visit the National Department of Health’s website.

Through a spouse or family member

If your spouse is covered through an employee insurance scheme, they may be able to add you to the plan as a dependent.

This is often a cost-effective way to get fairly good coverage for a variety of medical services.

If you are younger than 26 — whether married or unmarried — you can still be covered by your parents’ health insurance plan.

However, once you turn 26, you must get your own health insurance.

How Much Will Health Insurance Cost?

The cost of health insurance can vary widely, depending on several factors other than the type of plan you choose. These factors may include:

Age: Your age is a primary factor in determining how much your insurance will cost. Older members typically pay higher premiums than younger ones because they are more likely to use healthcare services frequently.

Location: Health insurance costs vary by geographic location, usually reflecting the cost of living and local regulations in different areas. For example, urban areas may have higher premiums than rural areas due to the higher cost of medical services.

Tobacco use: Smokers generally pay higher insurance premiums than nonsmokers due to an increased risk of developing serious health conditions. This can significantly affect the cost of your premiums, sometimes by up to 50%.

Depending on these factors, the average premium for an individual health insurance plan is around $702 per month.

Family plans are more expensive, with an average cost of $1,997 per month.

These costs could also fluctuate, depending on the level of coverage you require and any additional benefits included in the plan.

Are There Any Tax Benefits to Health Insurance?

For self-employed individuals, health insurance not only provides essential coverage but also has several tax advantages.

This can help you manage your finances more effectively and make the most of the money you spend on health insurance.

Health insurance deduction

If you are self-employed and not eligible to participate in a health plan through your spouse’s employer, you can benefit from an overall tax reduction.

In these cases, you can deduct the premiums you pay for medical, dental, and some long-term care insurance for yourself and any dependents on your plan.

This deduction is taken on your Form 1040, which reduces your adjusted gross income to lower the amount you must pay tax on at the end of the year.

Health savings account (HSA) contribution

If you have a comprehensive plan, you can often contribute to a benefit called a Health Savings Account (HSA).

An HSA helps you to pay for expenses that are not covered by your insurance, instead of paying out-of-pocket.

Contributions made to an HSA are deductible from your federal taxes, and the funds in the account grow tax-free.

This means your taxable income is reduced, and you’ll have to pay less when tax season rolls around.

Tax credits via ACA

For individuals purchasing insurance through the Health Insurance Marketplace, premium tax credits are available.

These credits can be applied to your monthly premiums to lower the cost, be used to cover out-of-pocket expenses, or be claimed on your tax return at the end of the year.

When Can You Join a Health Insurance Plan?

There are two main periods during which you can enroll in or make changes to your health insurance plan:

Open enrollment period

The open enrollment period is the annual window during which individuals can enroll in a health insurance plan through the Health Insurance Marketplace.

For most states, this period typically runs from November 1st to December 15th, with coverage starting on January 1st of the following year.

During this time, you can compare plans, adjust your current coverage, or enroll in a new plan.

Be sure to review your health insurance needs annually and make changes during this period if you need to.

Special enrollment period

If you miss the open enrollment period, you may still have the opportunity to apply for or change your health insurance plan.

However, this is only possible if you qualify for a special enrollment period. Qualifying events for this enrollment period include:

Life events such as marriage, divorce, or having a baby

Losing other health coverage, which may occur if, for example, you’ve left your job

Moving to a new residence that changes your coverage area

Significant changes in your income that affect the coverage you qualify for

Becoming a U.S. citizen

A change in your incarceration status

The special enrollment period typically lasts 60 days from the date of the qualifying event, so it’s important to act quickly to ensure that you and your family remain covered.

Where Can You Get Dedicated Telehealth Services and Medical Advice?

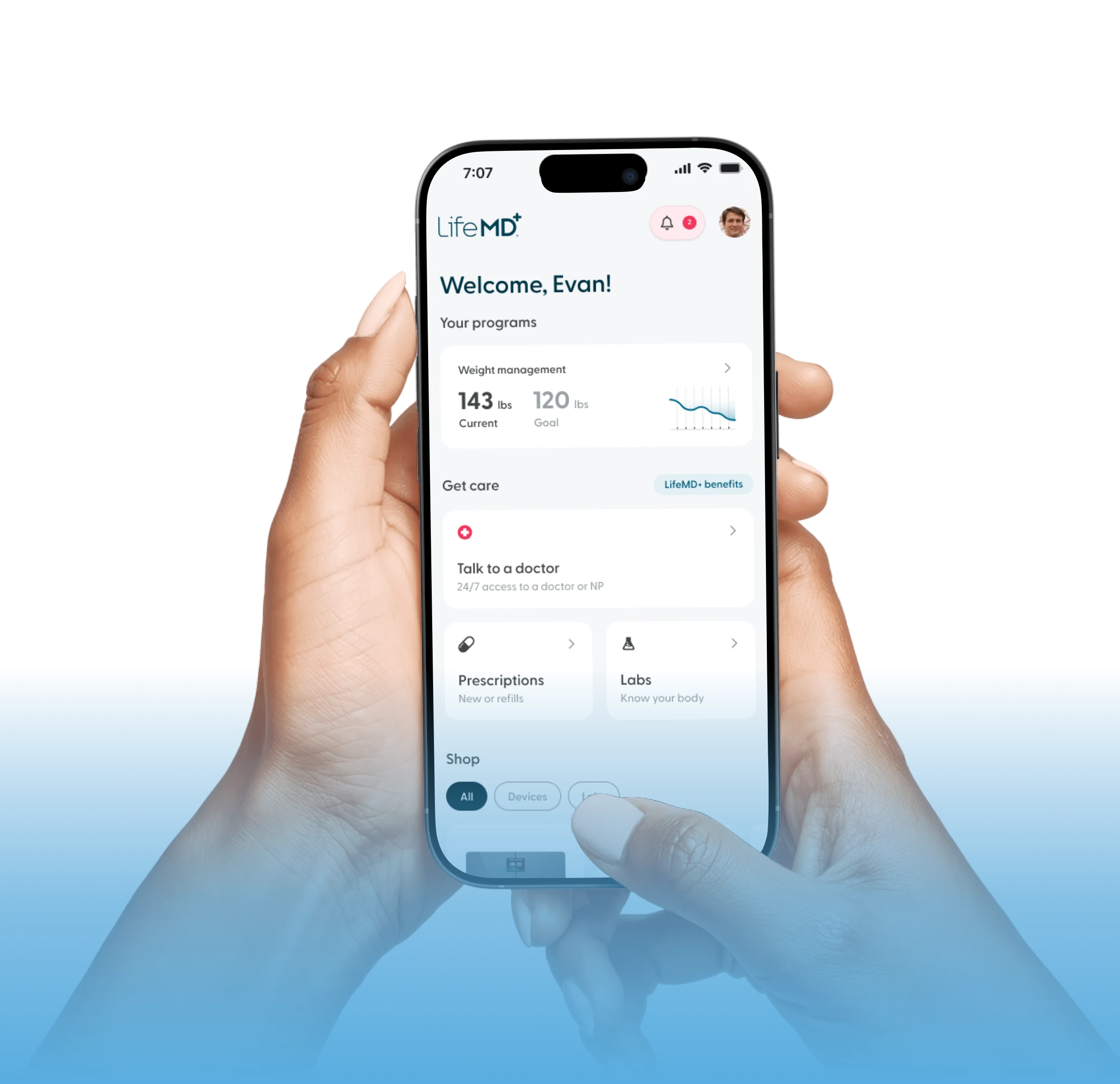

Through LifeMD, you can consult with a qualified healthcare provider from the comfort of your own home.

A team of board-certified physicians and nurse practitioners can treat a range of medical conditions, order blood work, and prescribe medication to help you take care of your well-being.

Make your online appointment today.