What is the Difference Between Medicare and Medicaid? Here’s What You Should Know

Many health insurance programs — like Medicare and Medicaid — are very similar, which can make it difficult to understand the differences between them.

However, knowing what these differences are is essential to choosing the right health insurance and accessing the medical services you need.

In this article, we’ll explore the key differences between Medicare and Medicaid.

Our goal is to help you understand the two programs better and know which one you need to apply for to avoid any gaps in your healthcare access.

What is Medicare?

Medicare is a federal health insurance program that covers medical expenses for seniors and younger people with disabilities or chronic conditions.

This program can help cover the cost of treatments, medicine, and other healthcare services when certain requirements are met.

Who is eligible for Medicare?

Medicare is available to the following people:

U.S. citizens over the age of 65

Younger individuals with disabilities

People of any age with end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS)

There are also additional requirements you must meet to be eligible for Medicare, even if you fall into these categories.

For example, if you are over the age of 65, you can only automatically qualify for Medicare if you or your spouse have been paying Medicare taxes for 10 or more years.

If not, you will have to enroll manually and pay a monthly fee to access any healthcare benefits.

In the case of disability, you can only apply for Medicare once you’ve received Social Security Disability Insurance (SSDI) for 24 months or more.

We cover these requirements in more detail in our dedicated Medicare coverage guide.

What does Medicare cover?

Medicare insurance is divided into four parts, with each one covering a different set of medical expenses. These parts include:

Part A (Hospital Insurance): This covers expenses like inpatient hospital stays, care in a skilled nursing facility, hospice care, and some forms of home healthcare. For most members, there is no premium for Part A due to having paid Medicare taxes while working.

Part B (Medical Insurance): This provides benefits for outpatient care (like blood tests, X-rays, or doctors’ visits), general doctors’ services (like diagnosing an illness), preventive services and screenings, and durable medical equipment (DME). Part B involves a monthly premium, which is based on your income.

Part C (Medicare Advantage): These plans are offered by private insurers and include all the benefits of Parts A and B, with additional services, like dental and vision care. Costs vary by plan and may involve monthly premiums and additional fees.

Part D (Prescription Drug Coverage): This helps to cover the cost of prescription medications. Available through Medicare-approved private insurers, Part D plans charge a monthly premium.

In most cases, you will qualify for Parts A and B — also known as Original Medicare — once you become eligible for health coverage.

You can then decide if you want to add Parts B and C to your insurance plan. If you do add them, you will usually have to pay a monthly premium to access the benefits.

Cost and premiums

While Part A is generally free — depending on if you’ve paid Medicare taxes or not — Parts B, C, and D require monthly premium payments.

The cost of these premiums vary depending on your income and the plan you’ve chosen.

Getting started with Medicare

If you don’t automatically qualify for Medicare, you will need to apply when you become eligible.

To do this, follow these steps:

1. Verify your eligibility for Medicare by visiting the Social Security Administration (SSA) website or by making an appointment at your local SSA office.

2. If you are eligible, you have to decide between Original Medicare (Parts A and B) and Medicare Advantage (Part C) based on your health needs and financial situation.

3. Apply during your Initial Enrollment Period (IEP), which typically begins three months before your 65th birthday and ends three months after. If you have a disability, your IEP starts in the month you receive your first disability benefits check.

Read our comprehensive guide on applying for Medicare to help you navigate this process with ease.

A Closer Look at Medicaid

Medicaid is a state and federally-funded program that provides health insurance to U.S. residents with limited income.

The program generally covers services like doctors’ visits, certain preventative screenings, long-term care, and X-rays under certain conditions.

Remember that coverage can also vary by state, with some areas having more or fewer benefits than others. We’ll take a closer look at what this means later on.

Who qualifies for Medicaid?

Medicaid eligibility is determined by your household income and specific circumstances. You may be eligible for Medicaid if you fall into any of these groups:

Low-income families, including parents and dependent children

Pregnant women with a low income

Seniors with a low income

Low-income individuals with disabilities

Children in foster care

If you are unsure if you are eligible for Medicaid, contact your local SSA office for help or visit the official Medicaid website.

What income bracket do you need to qualify for Medicaid?

To qualify for Medicaid, your income must generally fall within a certain bracket that is below the Federal Poverty Level (FPL).

The exact income amount varies by state and household size, but you typically need to have an income at or below 138% of the FPL to qualify for Medicaid.

You can check your household size against your yearly income to determine how far below the FPL you are by using the Poverty Guidelines Chart.

Benefits covered by Medicaid

Because each state runs its own Medicaid program, the benefits and services covered can vary.

However, the federal government has rules for state-run Medicaid programs and these indicate a list of services that should always be covered.

This means you’ll have coverage for these services no matter the state you live in. These services may include:

Physician services

Nursing facilities

X-rays

Midwife services for pregnancy and postpartum care

Pregnancy-related medical services

Certified pediatric services

Freestanding birth center services

Family planning services

Certified family nurse practitioners

Early and periodic screening, diagnostic, and treatment services

Federally qualified health center services

Home health services

Inpatient hospital services

Laboratory orders

Rural health clinic services

Outpatient hospital services for medically necessary treatments

Tobacco-cessation counseling for pregnant women

Emergency transportation for eligible individuals

In addition to the mandatory services mentioned above, states can also choose to cover additional medical expenses.

For an in-depth look at what these are, read our guide on Medicaid coverage.

What does Medicaid cost?

Individuals who qualify for Medicaid usually don’t have to pay anything to access their benefits.

Some states may require a small payment for certain services, but these costs are generally low.

Applying for Medicaid

Unlike Medicare, where you are automatically enrolled, you’ll need to apply for Medicaid. This process usually involves:

1. Determining if you are eligible for Medicaid in your state based on their guidelines. These can be found on the local Health Department’s website.

2. If you are eligible, you’ll need to prepare the required documentation — like income statements, proof of identity, and proof of residence — to file along with your application.

3. You can then apply for Medicaid online, in person, or via post.

To learn more about the Medicaid application process, read our in-depth article.

Medicare vs. Medicaid: Key Differences at a Glance

Medicare | Medicaid | |

|---|---|---|

Plan Options | Original Medicare (Parts A and B). Medicare Advantage (Part C). Prescription Drug Coverage (Part D). | State-specific plans. Managed Care, which is a service that can help you understand and make the most out of your Medicaid benefits. |

Coverage | Dependent on the type of plan you choose: - Part A and B covers hospital and medical insurance. - Part C includes additional benefits for services like vision and dental coverage. - Part D covers prescription drugs and services like vaccinations. | Comprehensive coverage, including hospital stays, doctors’ visits, and more, depending on your state. Certain states may offer additional benefits to members |

Eligibility Requirements | U.S. citizens aged 65 and older. Younger individuals with disabilities or specific chronic conditions. | Income-based which varies by state. Includes specific life circumstances, such as pregnancy, age, or disability. |

Additional Benefits | Medicare Advantage plans (Part C) include additional benefits such as dental, vision, and hearing coverage. | May include additional benefits, depending on which state you live in. Generally offers more coverage than Medicare, including paying for services like adult day care, hospice, and more. |

Cost | Part A can be premium-free under specific conditions. Premiums for Parts B, C, and D can vary based on your income. | Free or low-cost for eligible individuals. Some states may require a small payment for certain services. |

Frequently Asked Questions (FAQs)

Can you have both Medicare and Medicaid?

It’s possible to have both Medicare and Medicaid. Individuals who qualify for this are known as "dual eligibles."

In these cases, Medicare typically covers your Part A (hospital insurance) and Part B (medical insurance) premiums and services.

Medicaid then covers additional services that Medicare doesn’t — such as certain dental, vision, and hearing aids. The program will also cover your Medicare premiums.

What happens if your income changes?

Medicare: Changes in income can affect the premiums for Medicare Part B and Part D. If your income decreases, you might qualify for the Medicare Savings Program (MSP), which can help pay for Part A and Part B premiums, deductibles, and co-payments.

Medicaid: Since Medicaid eligibility is based on income level, a change in income can determine if you qualify for this insurance or not. If your income becomes higher than the FPL limit, you may lose your Medicaid coverage. Similarly, a decrease in income might make you eligible for Medicaid if you were not previously.

Are prescription drugs covered by both Medicaid and Medicare?

Medicare: Part D of Medicare provides prescription drug coverage. You need to enroll in a Medicare-approved Part D plan to receive this coverage.

Medicaid: Prescription drug coverage is a mandatory component of Medicaid services. Medicaid often covers some medications that Medicare may not, with little to no extra cost to you.

Can you get help paying Medicare premiums if you have a low income?

The Medicare Savings Programs can help low-income individuals pay for their Medicare premiums. There are several types of MSPs, each with their own income and resource limits.

Common MSP options include:

You can visit the relevant website for each program to find out more.

Where can you find a doctor that accepts Medicare and Medicaid?

You can find doctors who accept Medicare and Medicaid by using the provider directories on the respective websites. Your state's health department websites should also have this information.

Medicare offers a useful "Physician Compare" tool on its website, which can help you find doctors and healthcare providers who accept insurance.

For Medicaid, contacting your state Medicaid office is the best way to obtain a list of participating providers.

Where Can I Access Quality Medical Advice and Services?

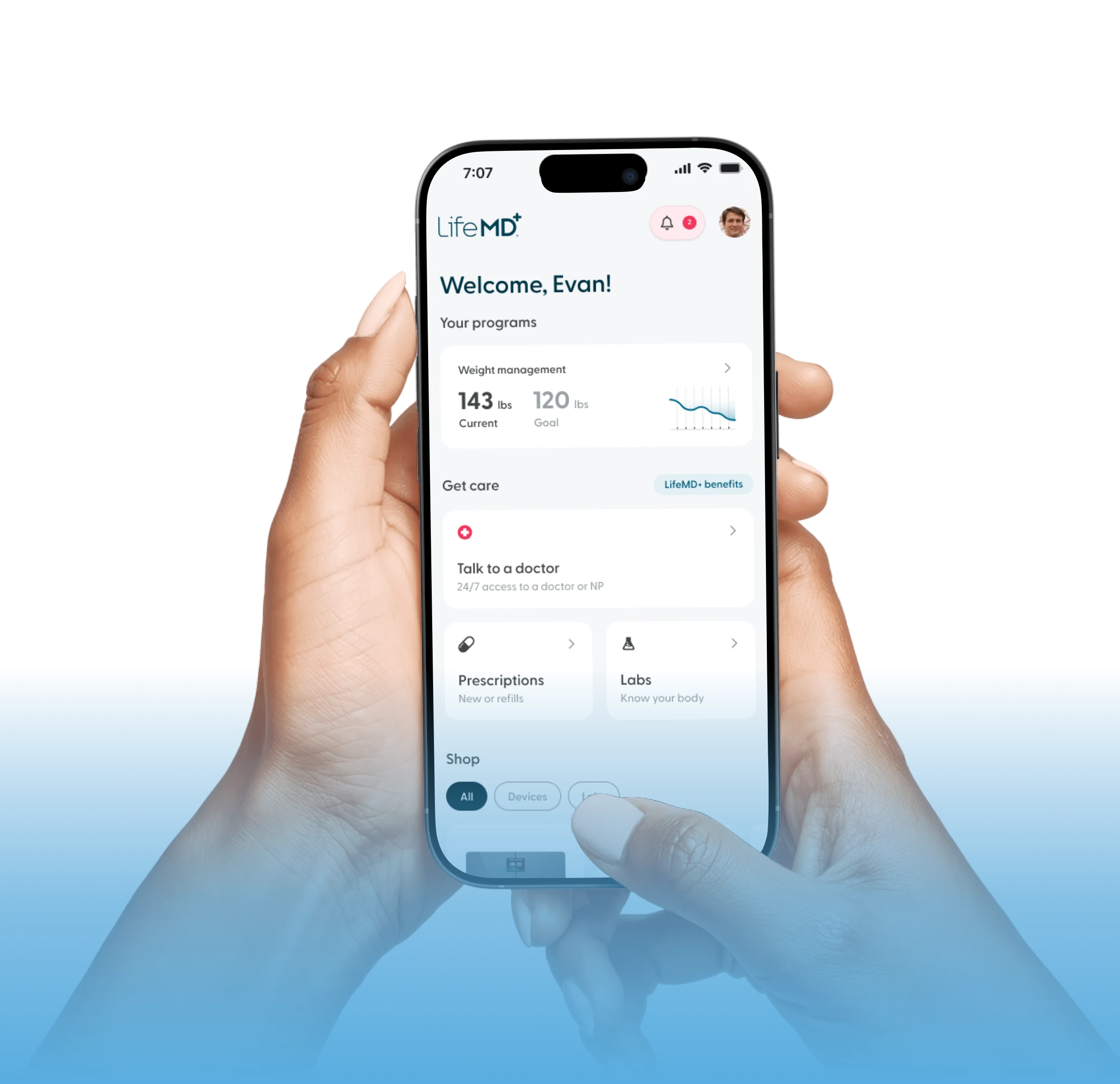

At LifeMD, dedicated healthcare professionals are ready to help you take control of your well-being.

We offer a range of telehealth services, including virtual consultations with licensed doctors, prescriptions, lab orders, and more.

Simply make an appointment with LifeMD today to get the healthcare you need – all from the comfort of your own home.